WenYi Trinity Technology Co., Ltd

600520 SHA

Weekly Summary

WenYi Trinity Technology Co., Ltd closed at 28.8600 (-0.31% WoW) . Data window ends Mon, 22 Sep 2025.

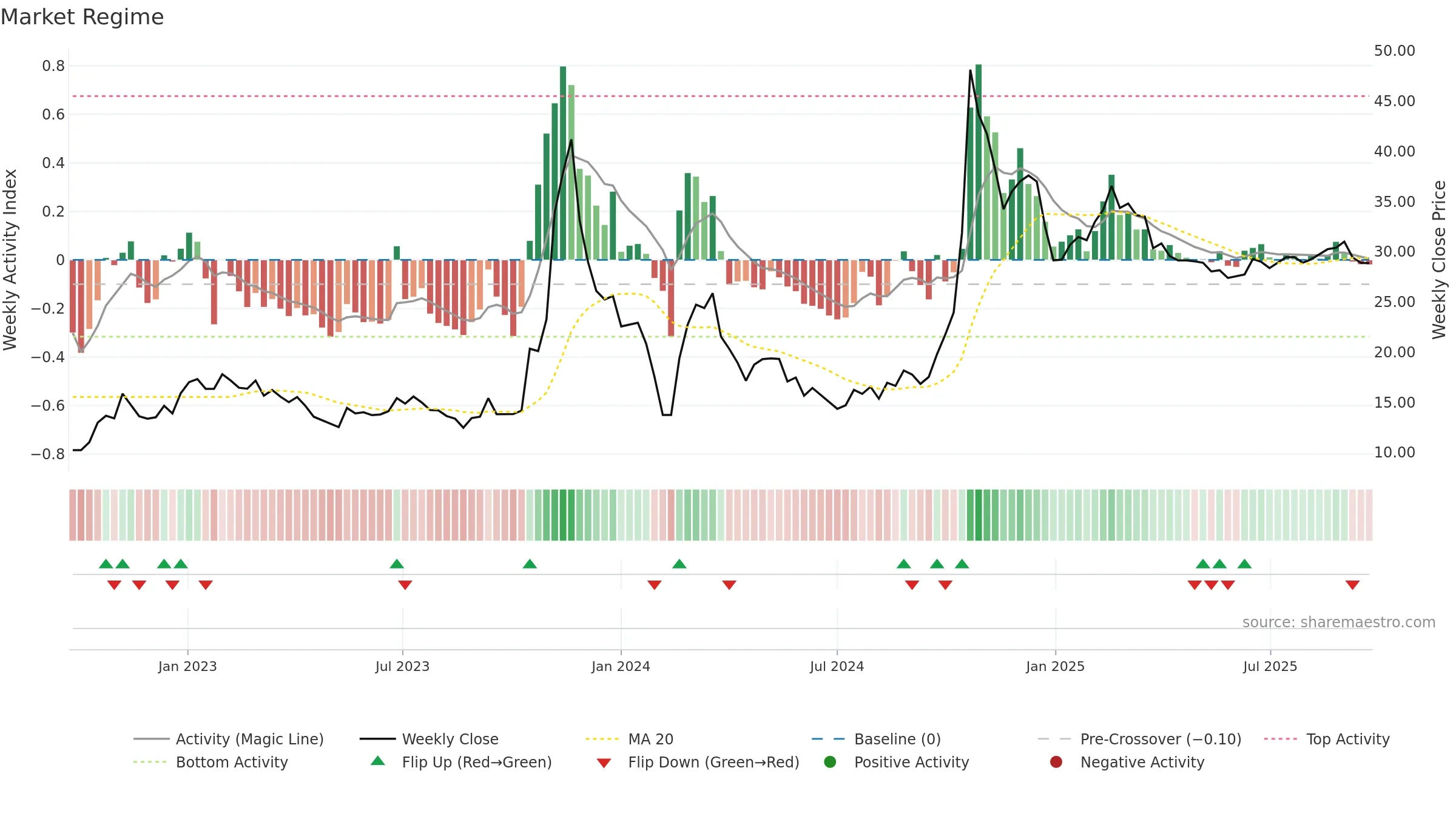

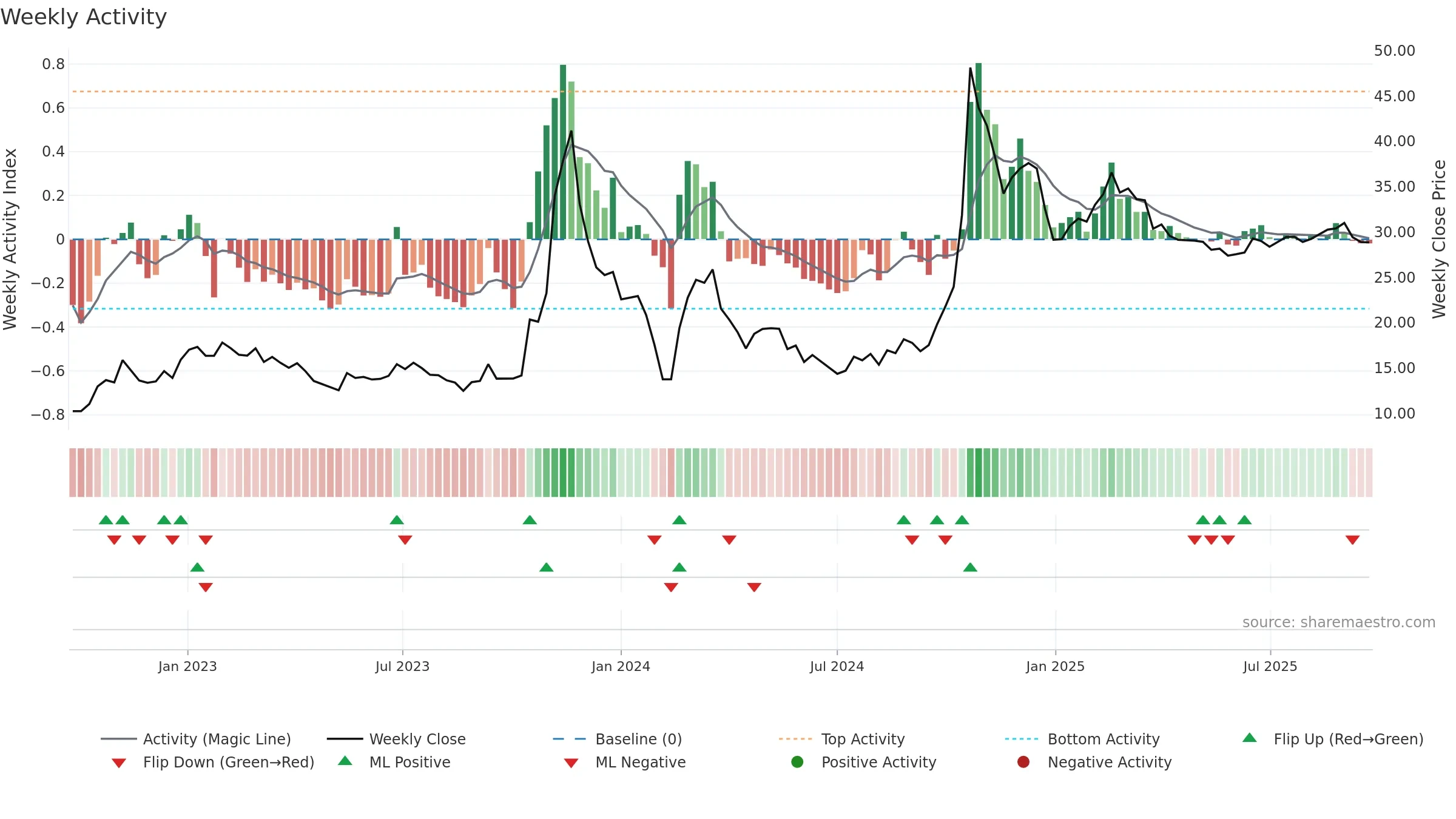

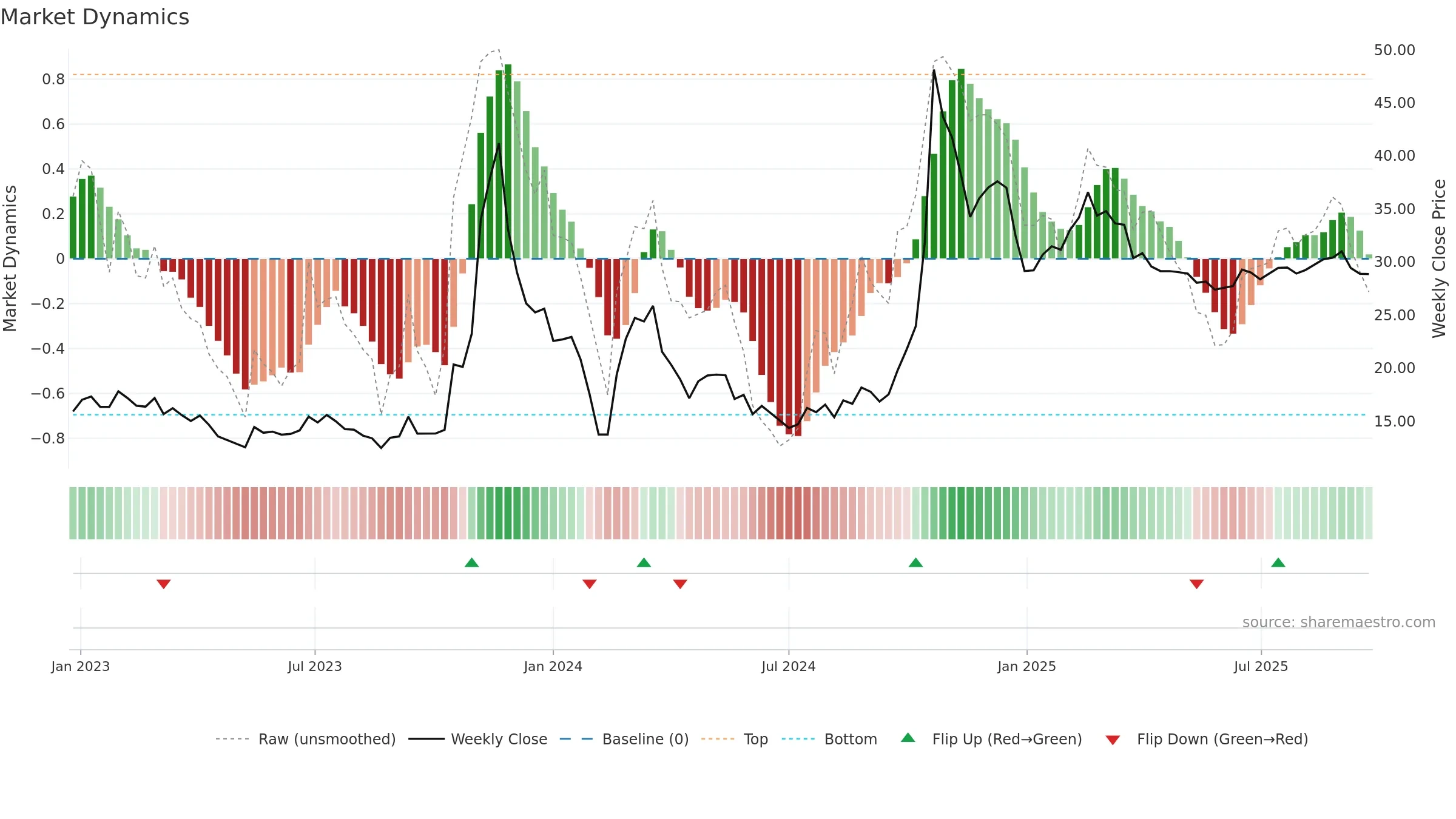

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

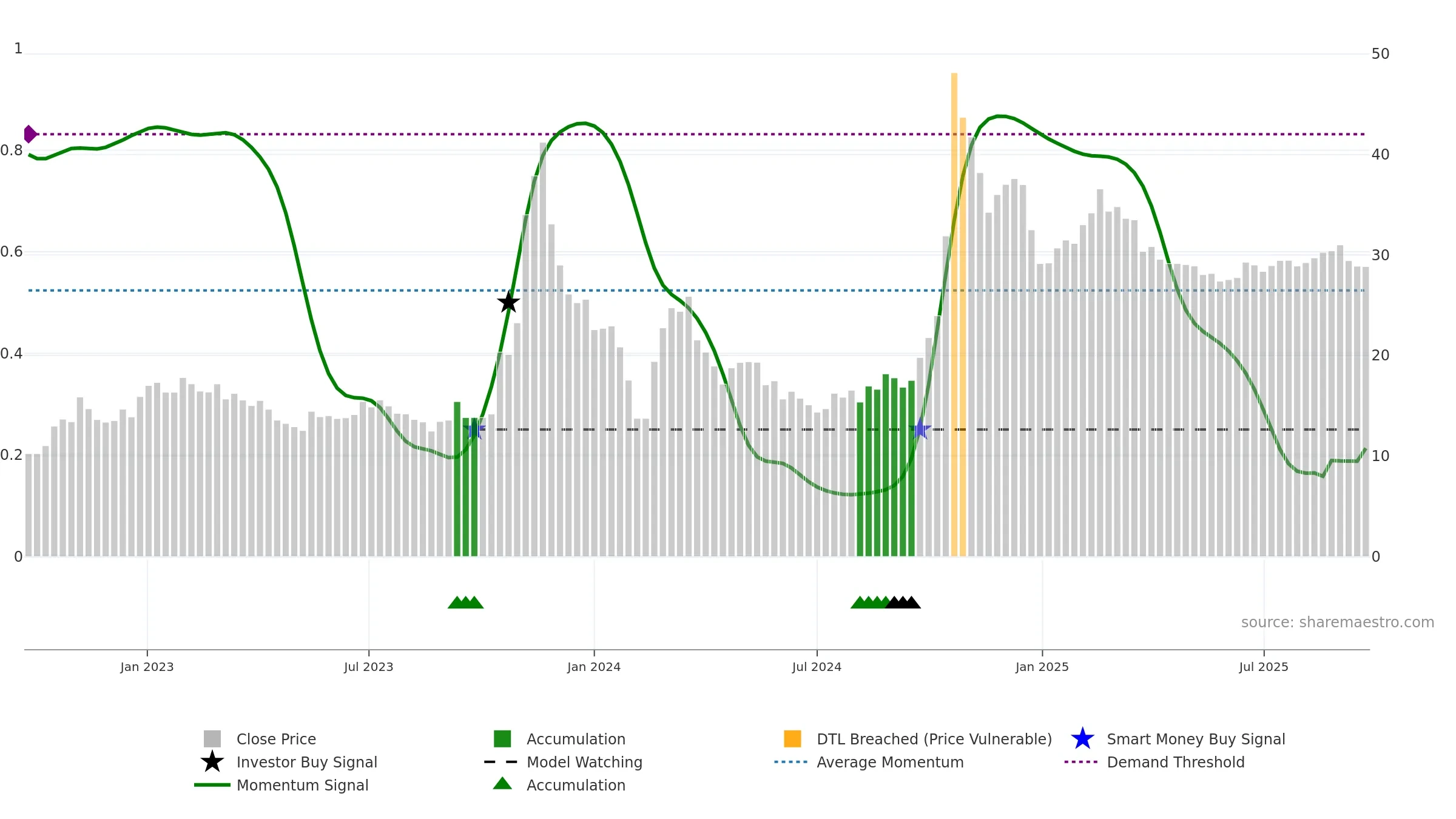

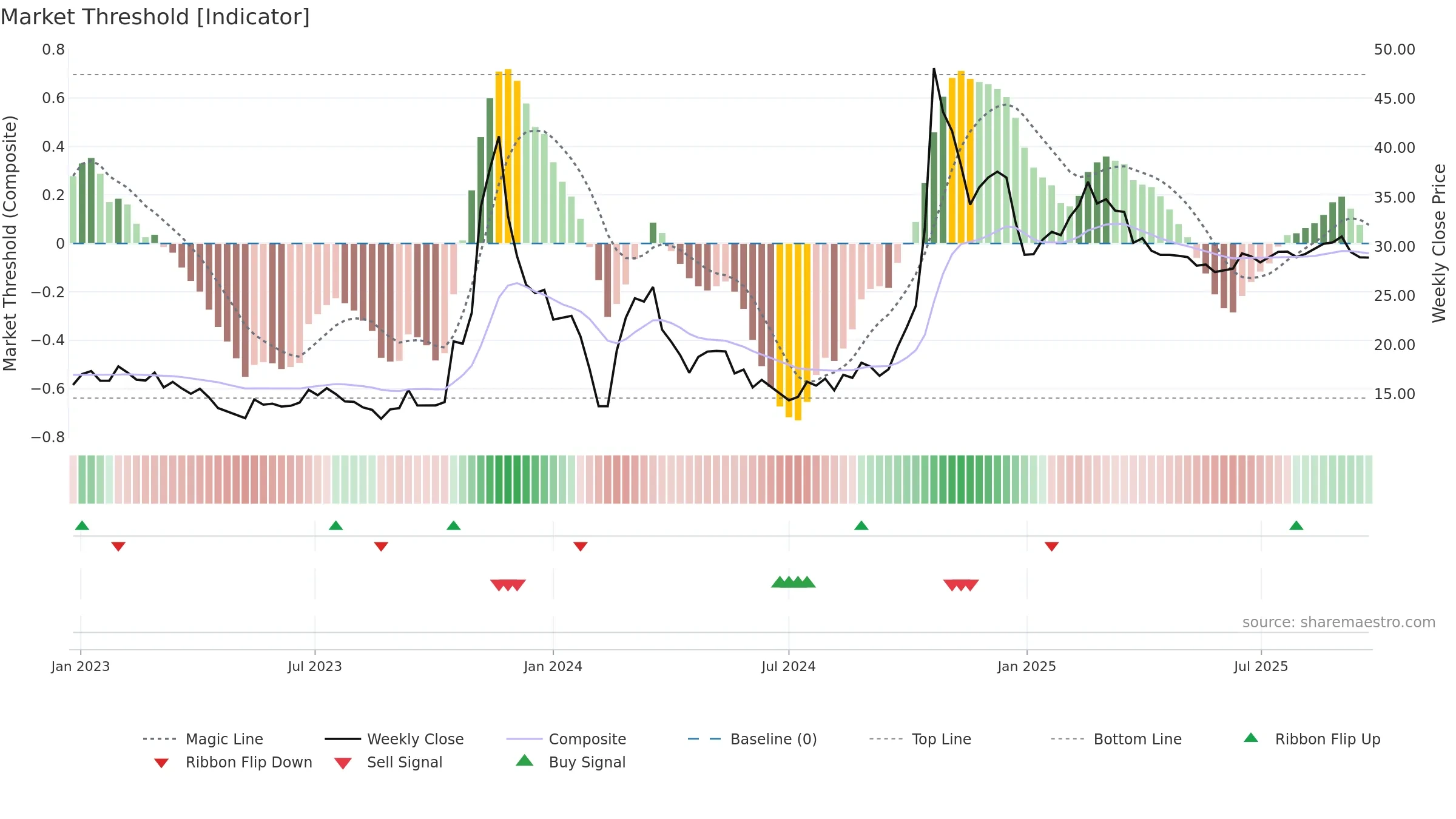

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

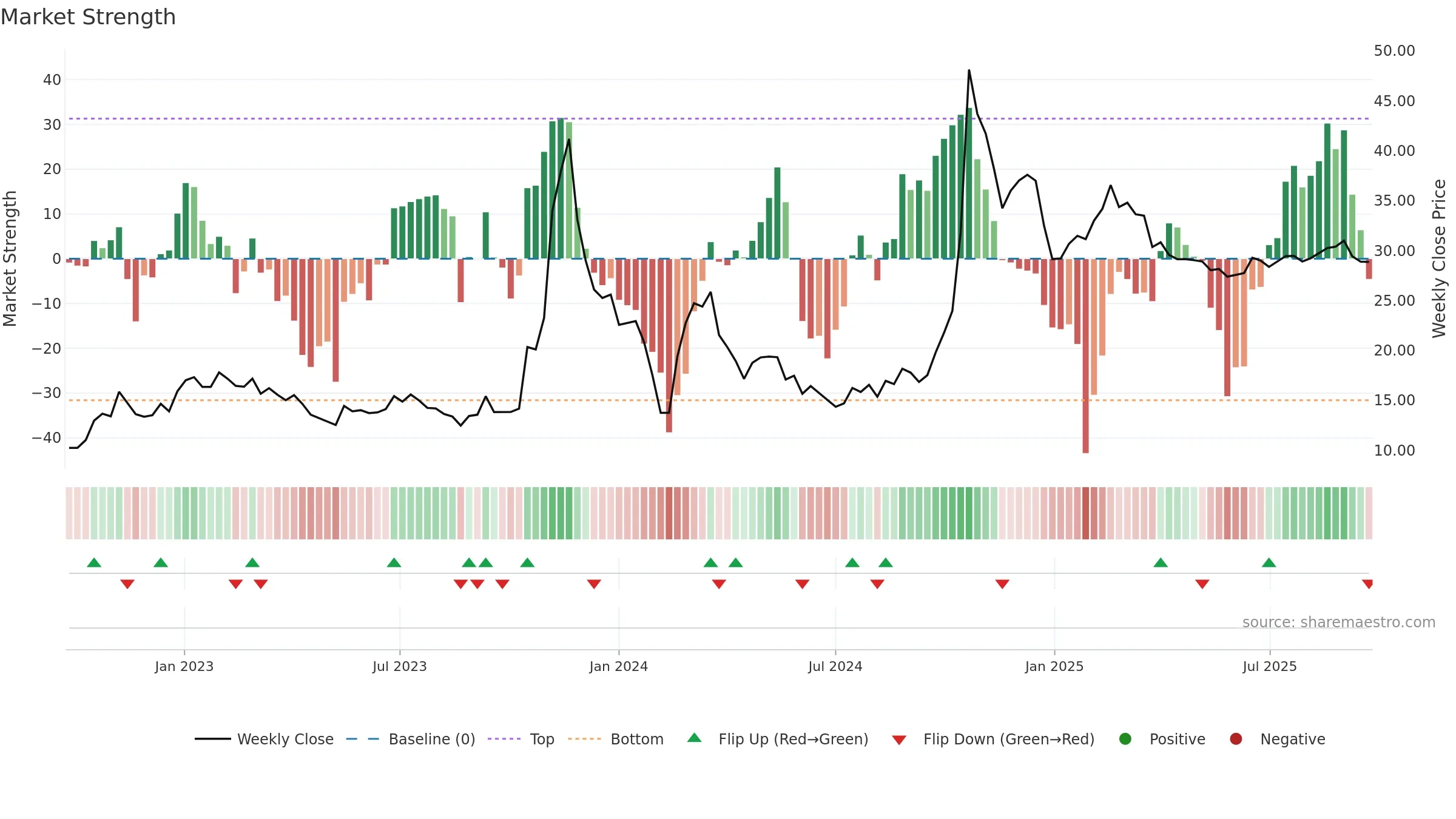

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -16.76% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

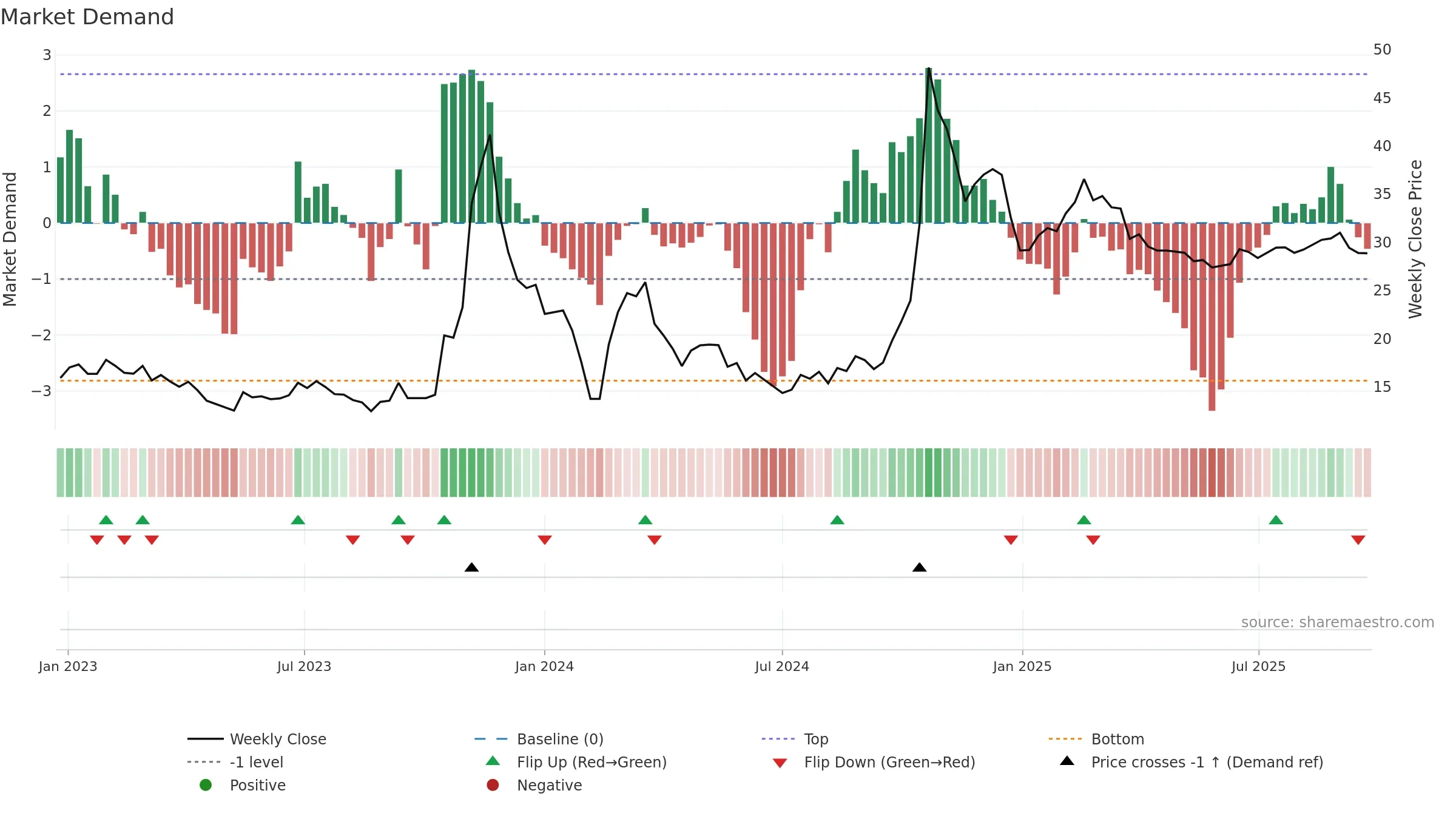

Price is above fair value; upside may be capped without catalysts.

Conclusion

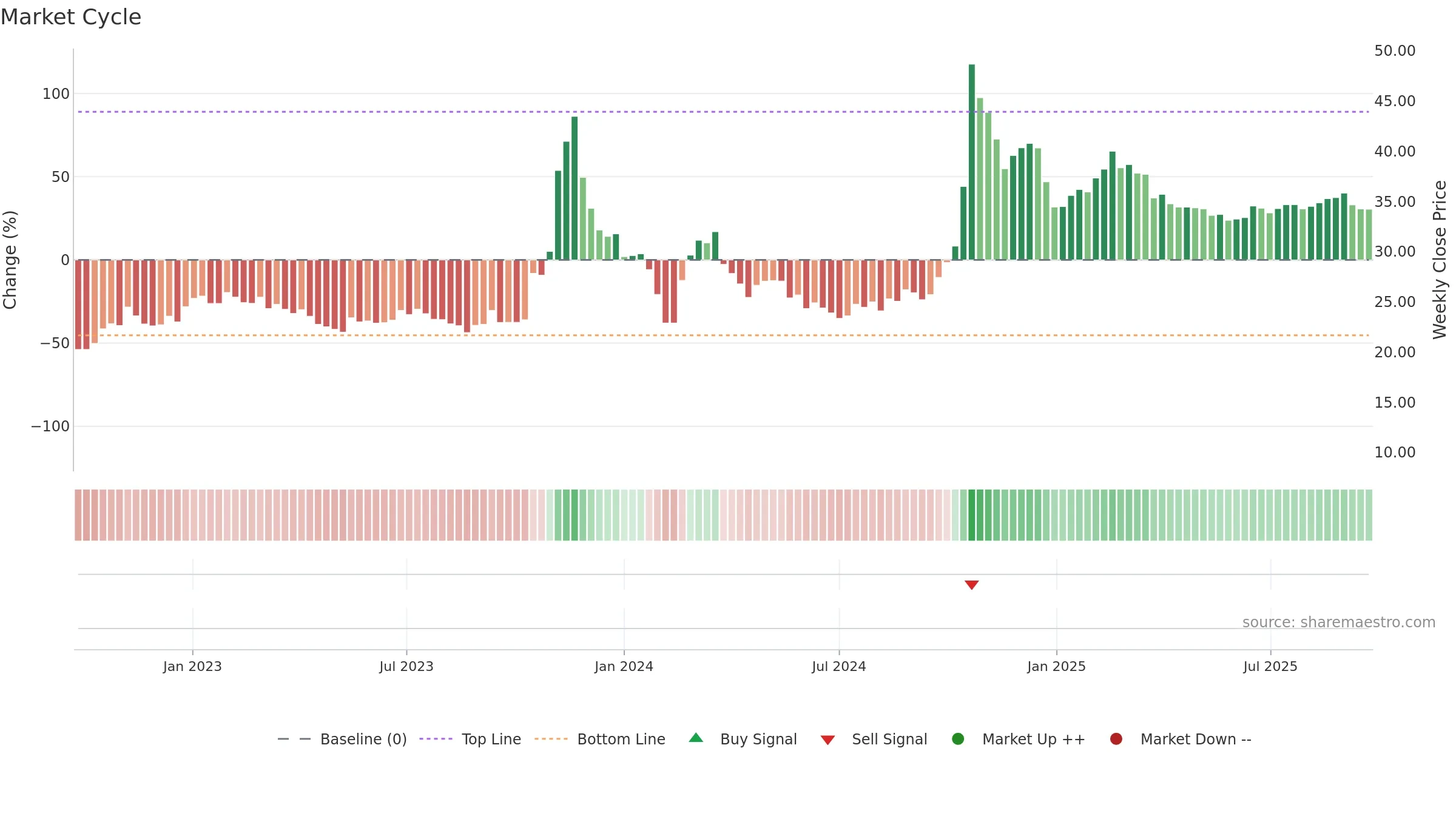

Neutral setup. ★★⯪☆☆ confidence. Trend: Range / Neutral · -1.30% over window · vol 1.85% · liquidity convergence · posture below · RS weak · leaning negative

- Liquidity confirms the price trend

- Low return volatility supports durability

- Price is not above key averages

- Negative multi-week performance

- Mansfield RS: weak & falling

Why: Price window -1.30% over w. Close is -6.90% below the prior-window high. Return volatility 1.85%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. 4–8w crossover bearish. Momentum neutral and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.