KLN Logistics Group Limited

0636 HKG

Weekly Report

KLN Logistics Group Limited closed at 7.6700 (0.92% WoW) . Data window ends Mon, 15 Sep 2025.

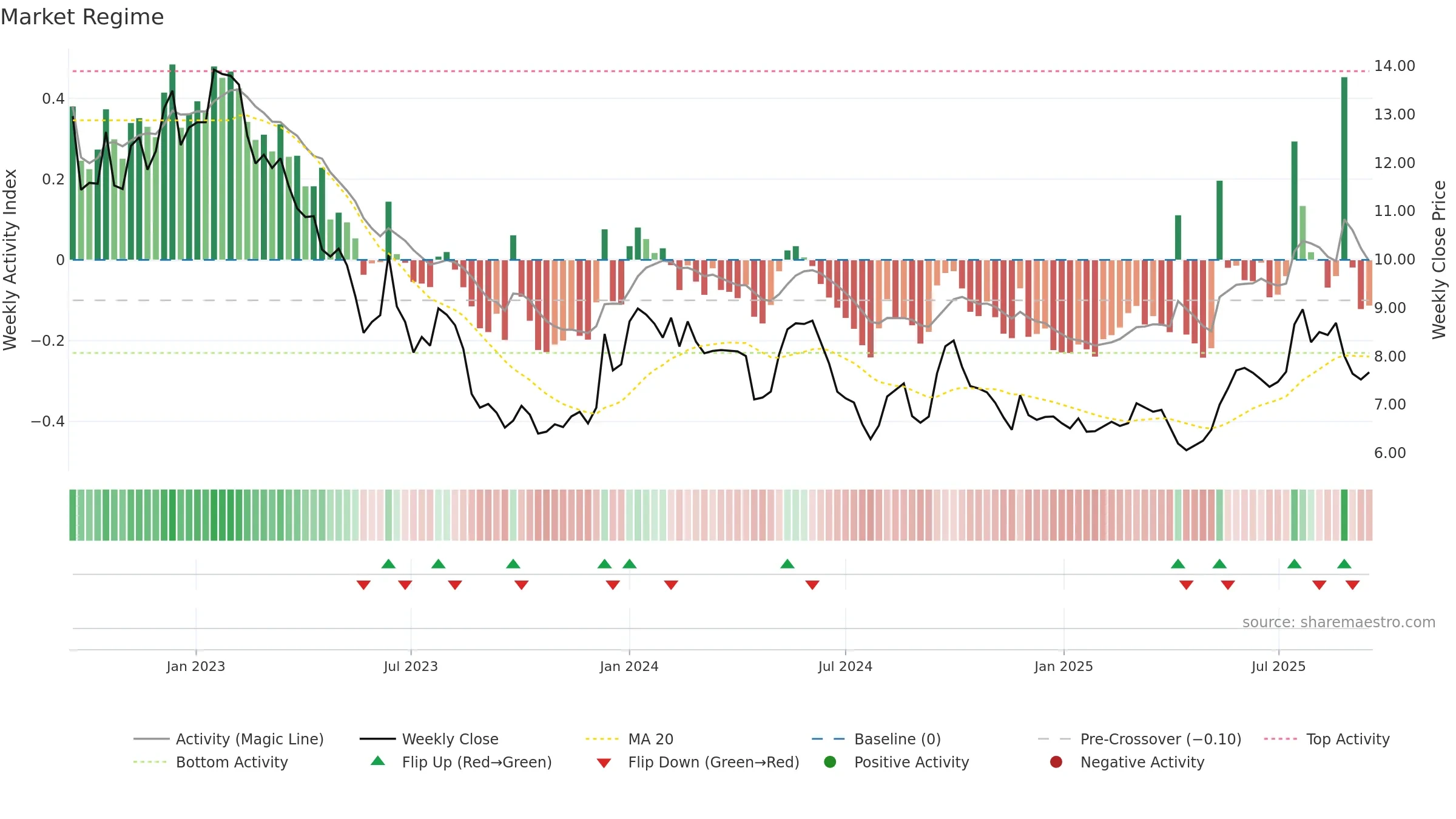

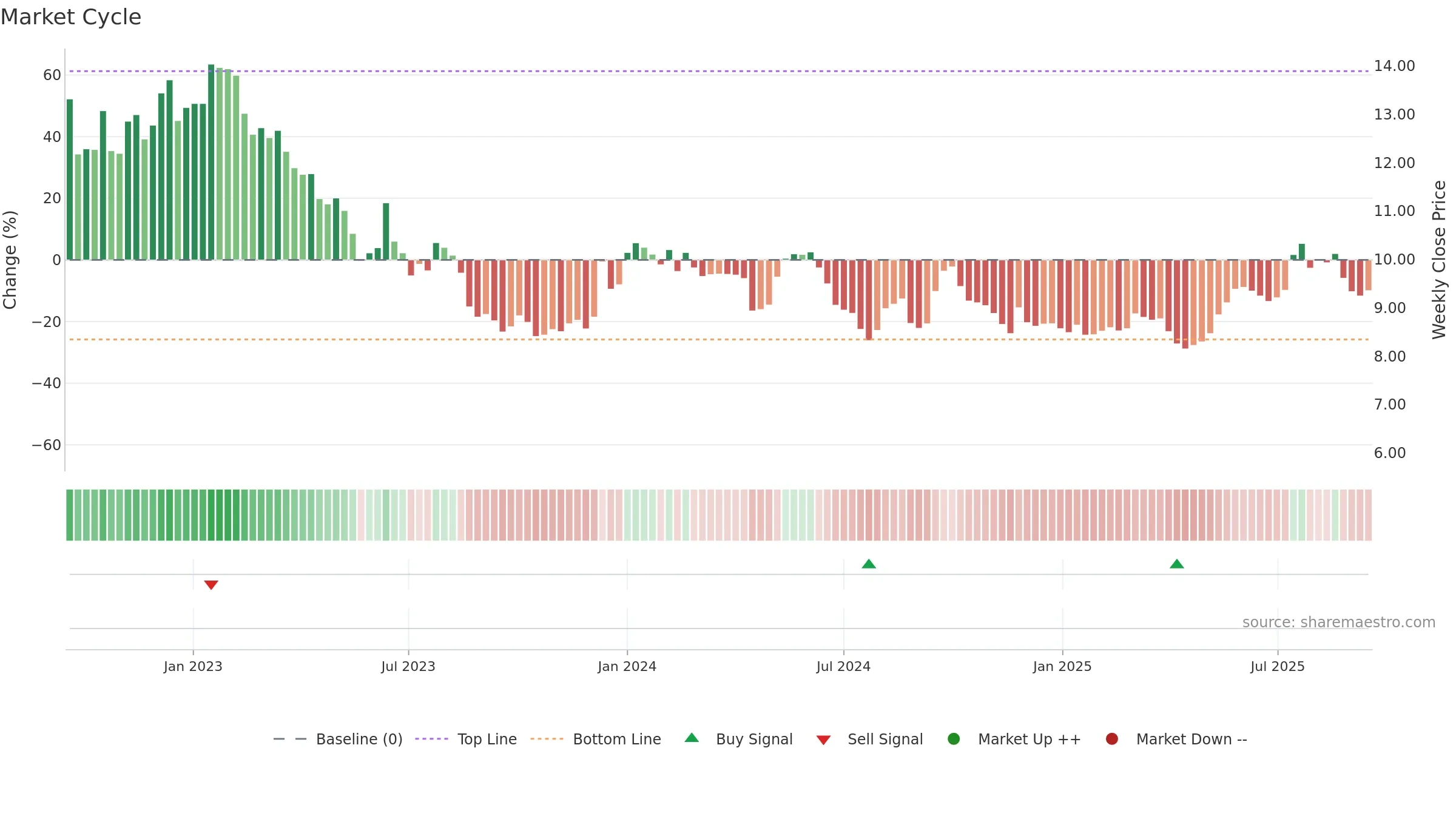

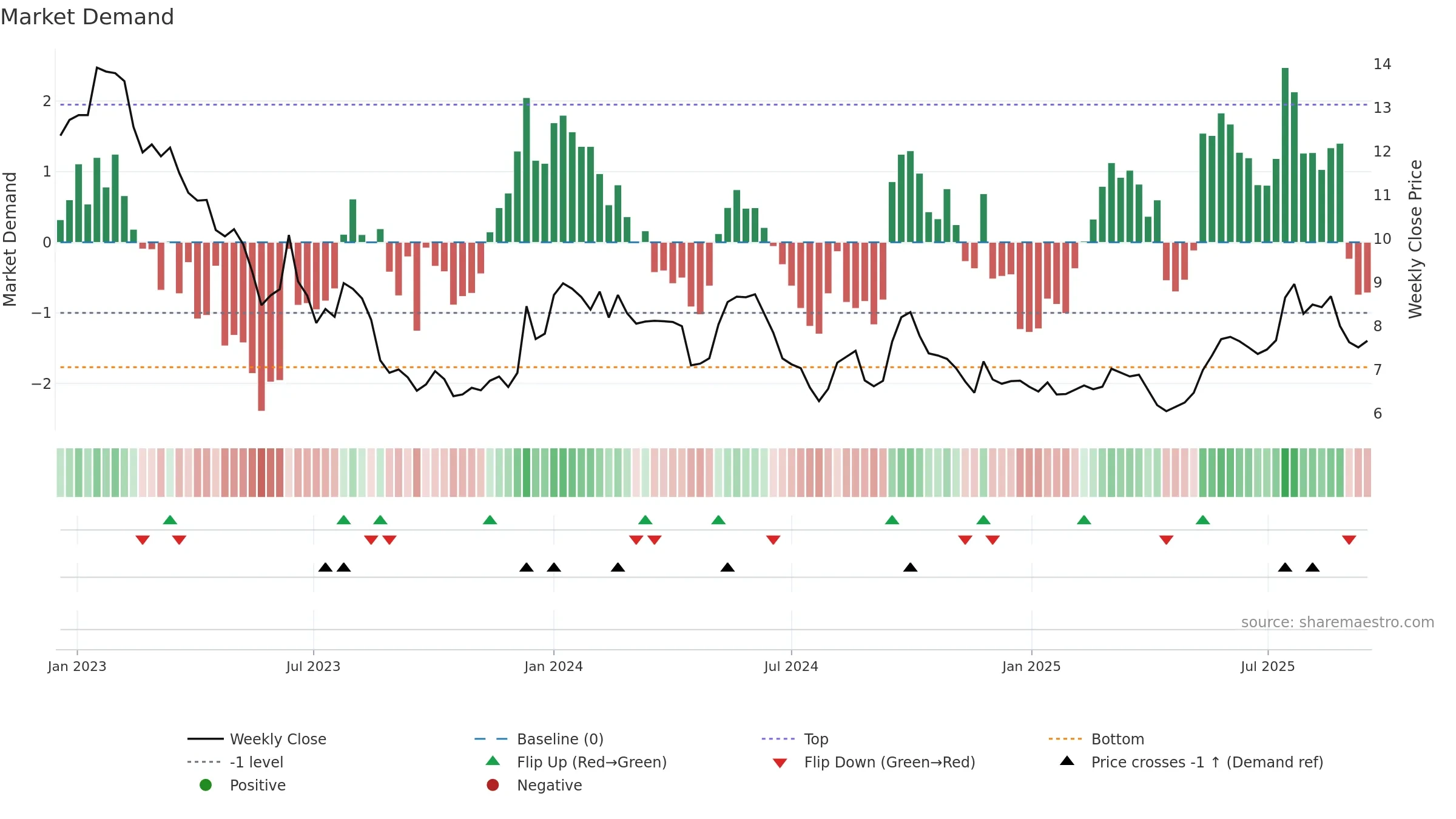

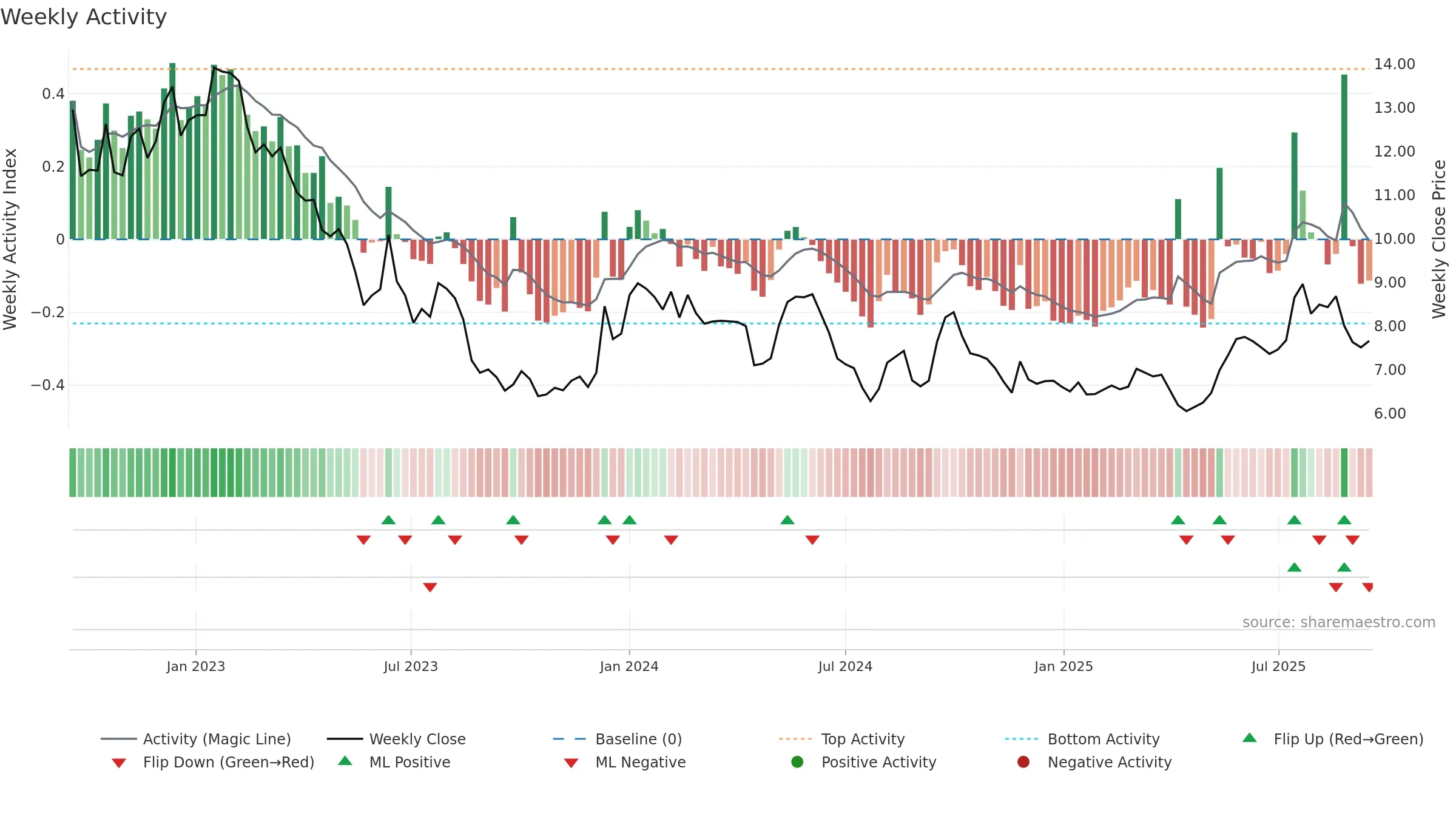

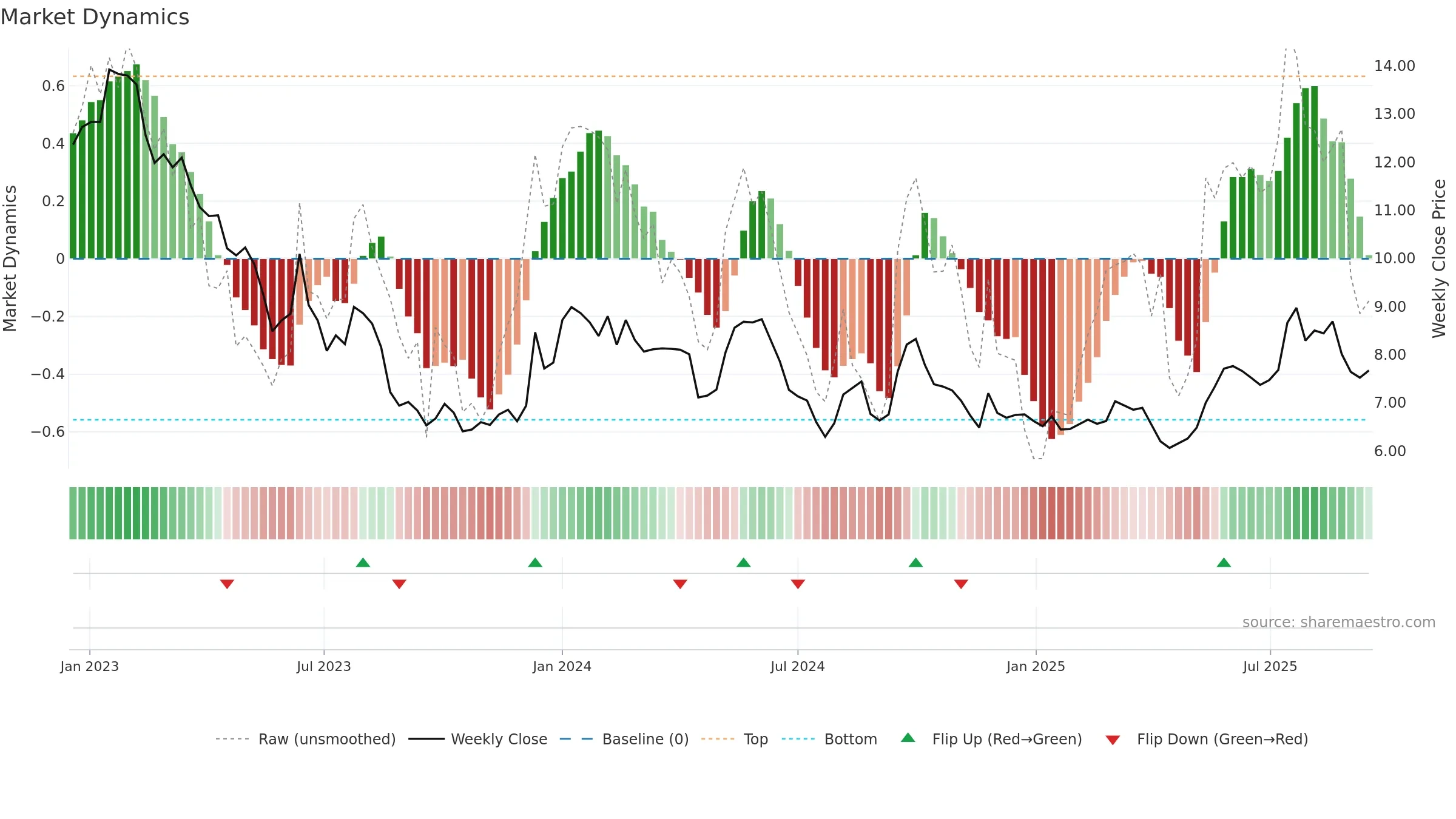

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

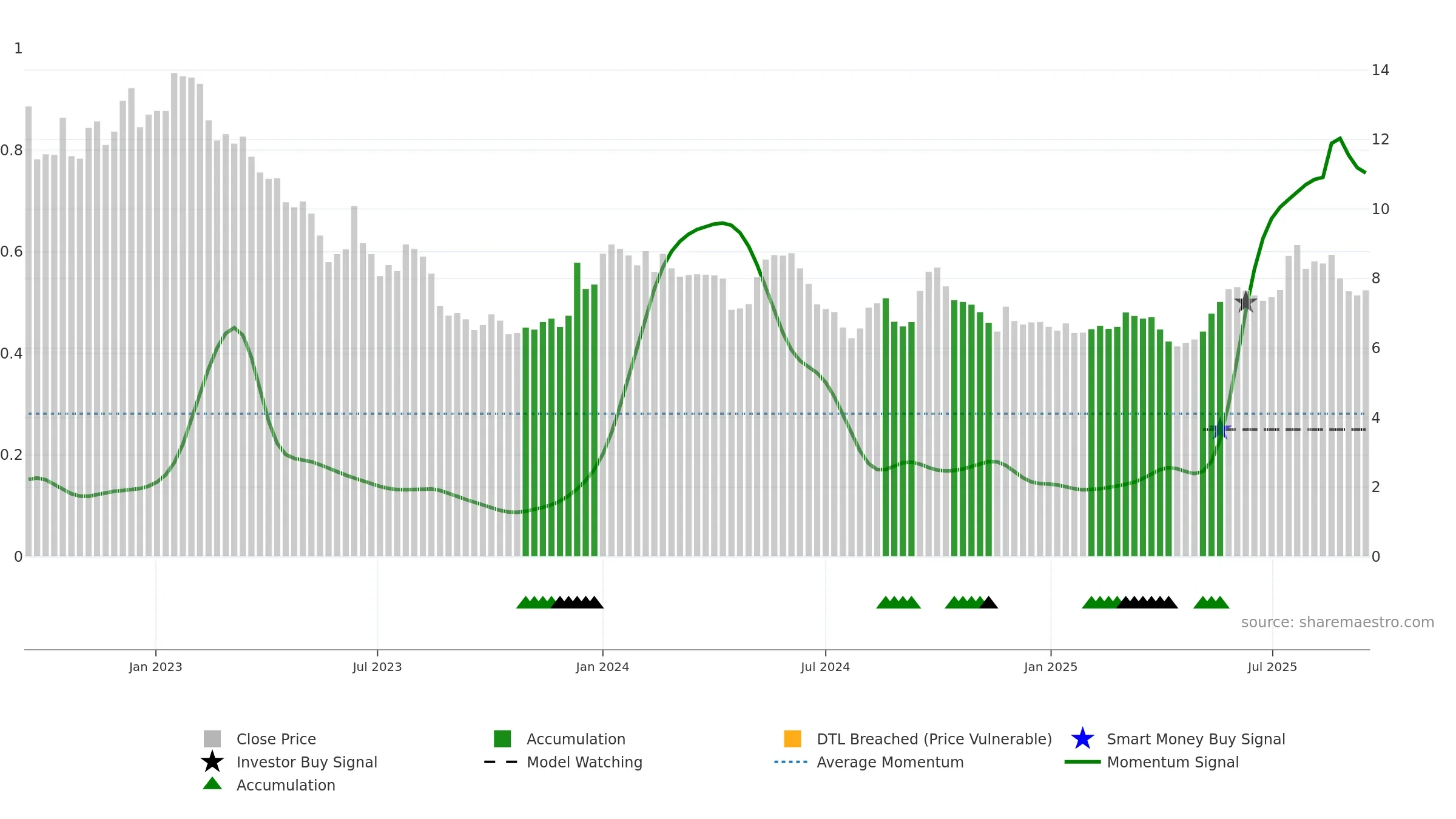

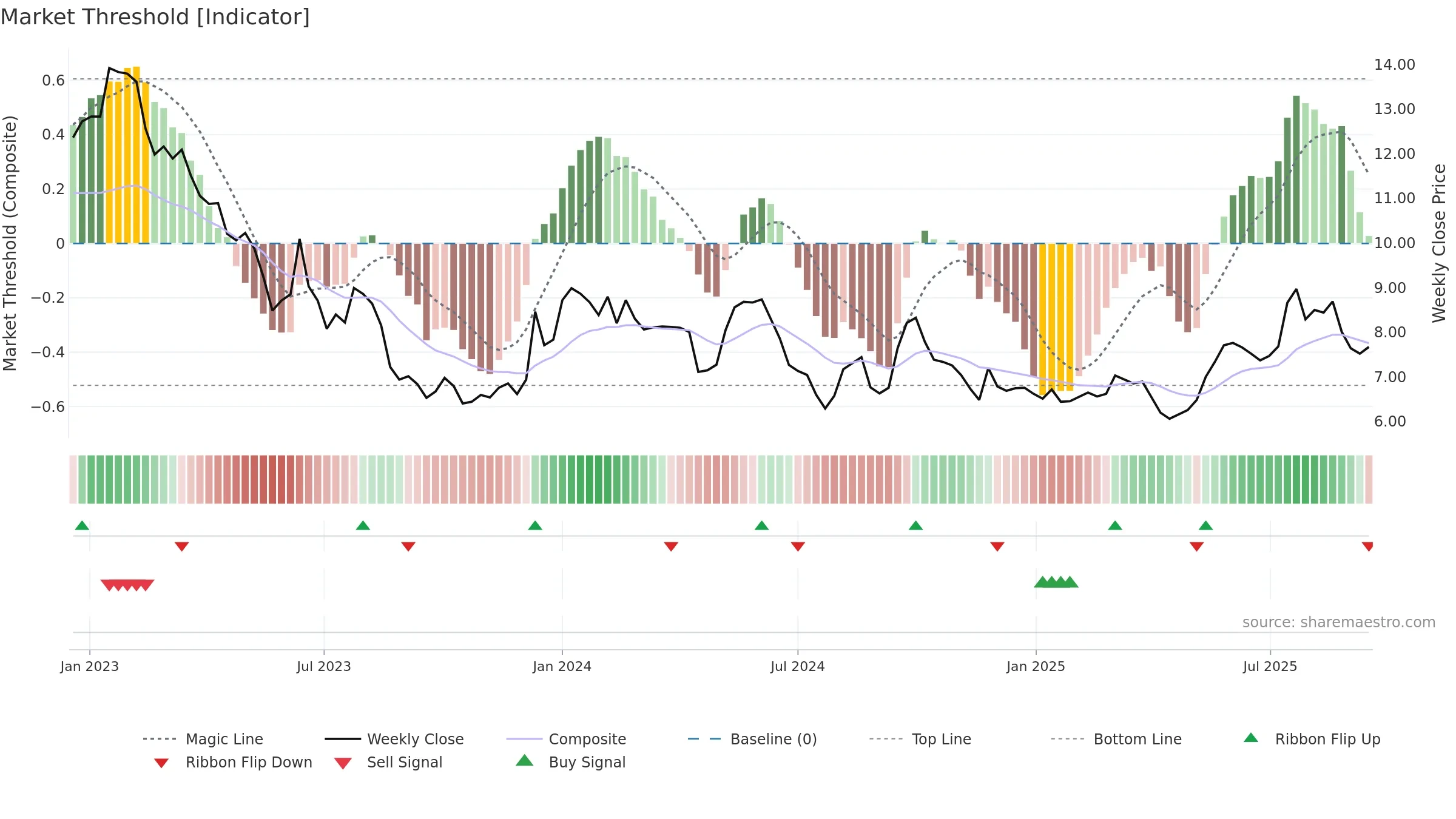

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising. Notable breakdown from ≥0.80 weakens trend quality.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

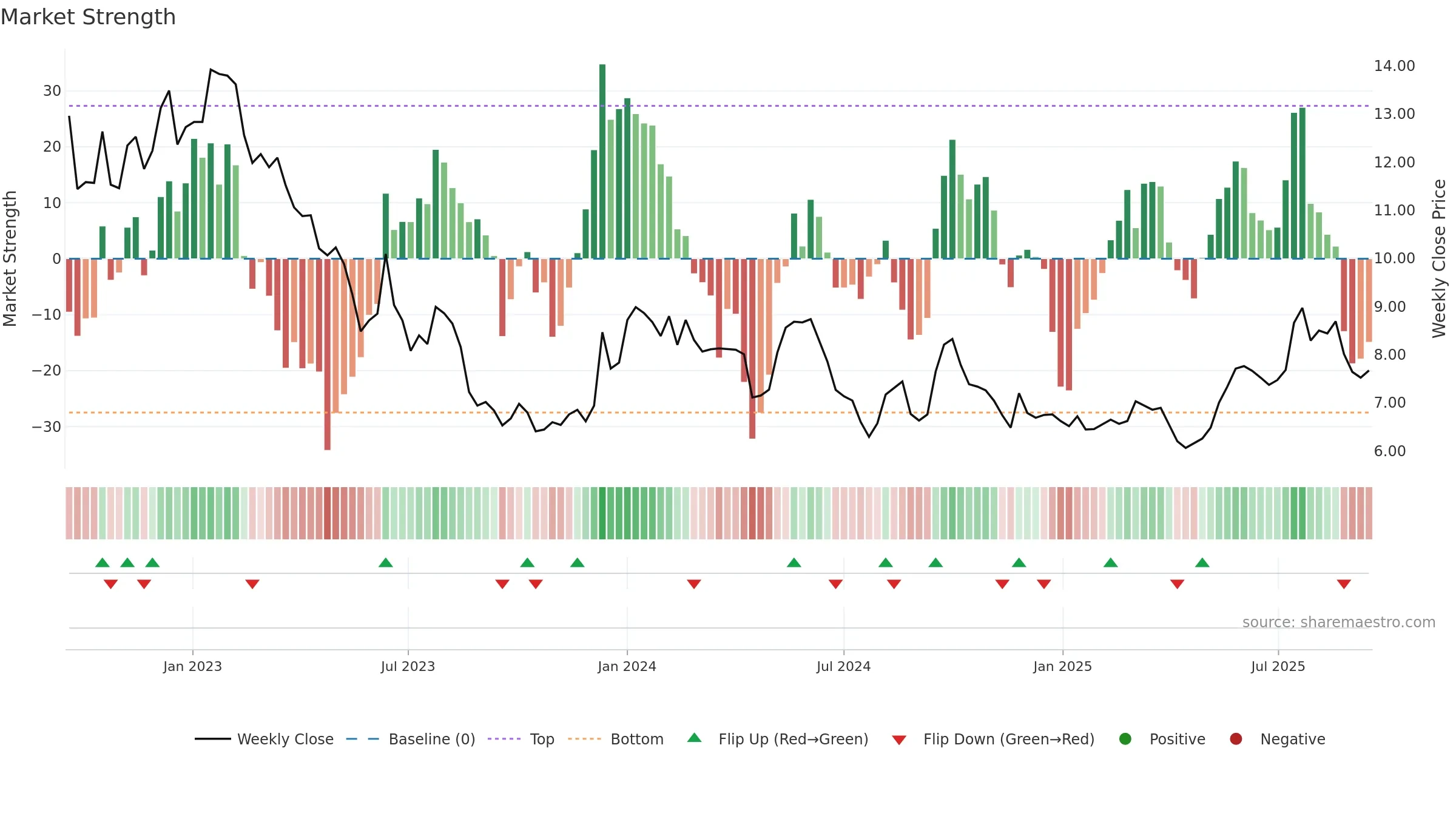

Negative setup. ★★☆☆☆ confidence. Price window: -7. Trend: Uptrend at Risk; gauge 75. In combination, liquidity diverges from price.

- Momentum is bullish and rising

- High-level but rolling over (topping risk)

- Price is not above key averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window -7.48% over 8w. Close is -11.74% below the prior-window high. Return volatility 5.34%. Volume trend rising. Liquidity divergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 1/2 (50.0%) • Accumulating. Momentum bullish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.