Kempower Oyj

KEMPOWR HEL

Weekly Report

Kempower Oyj closed at 16.9900 (1.49% WoW) . Data window ends Mon, 15 Sep 2025.

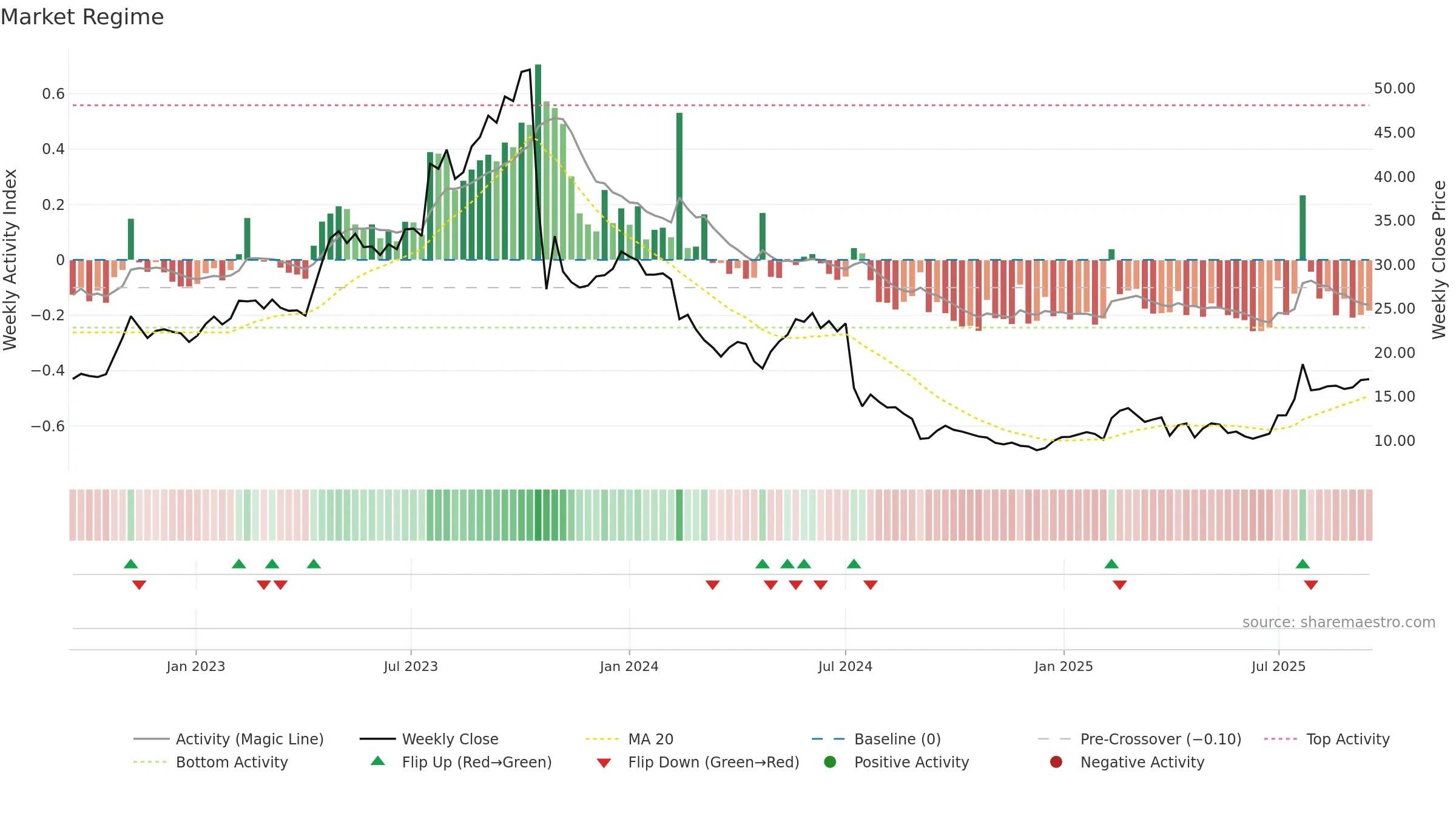

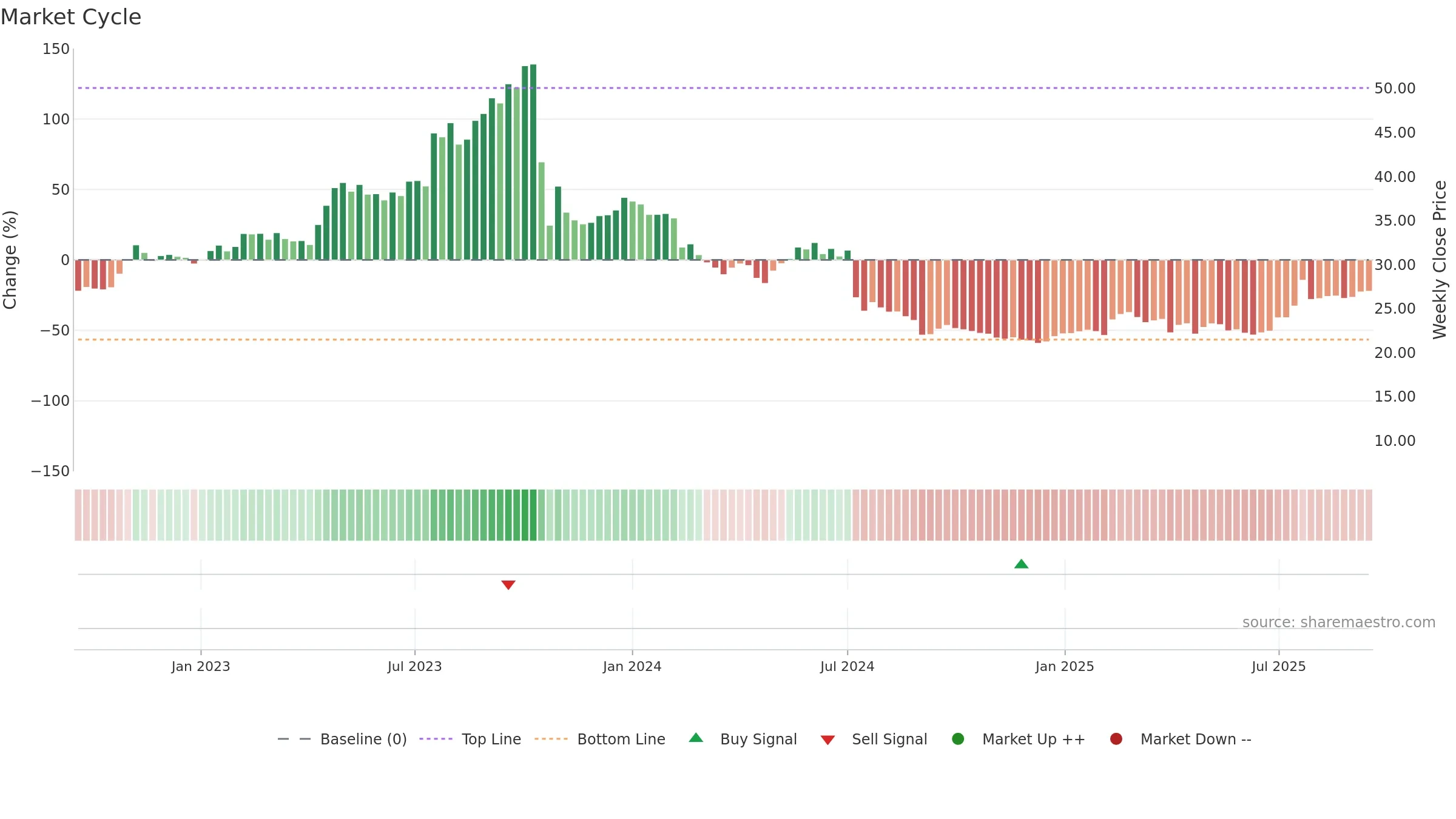

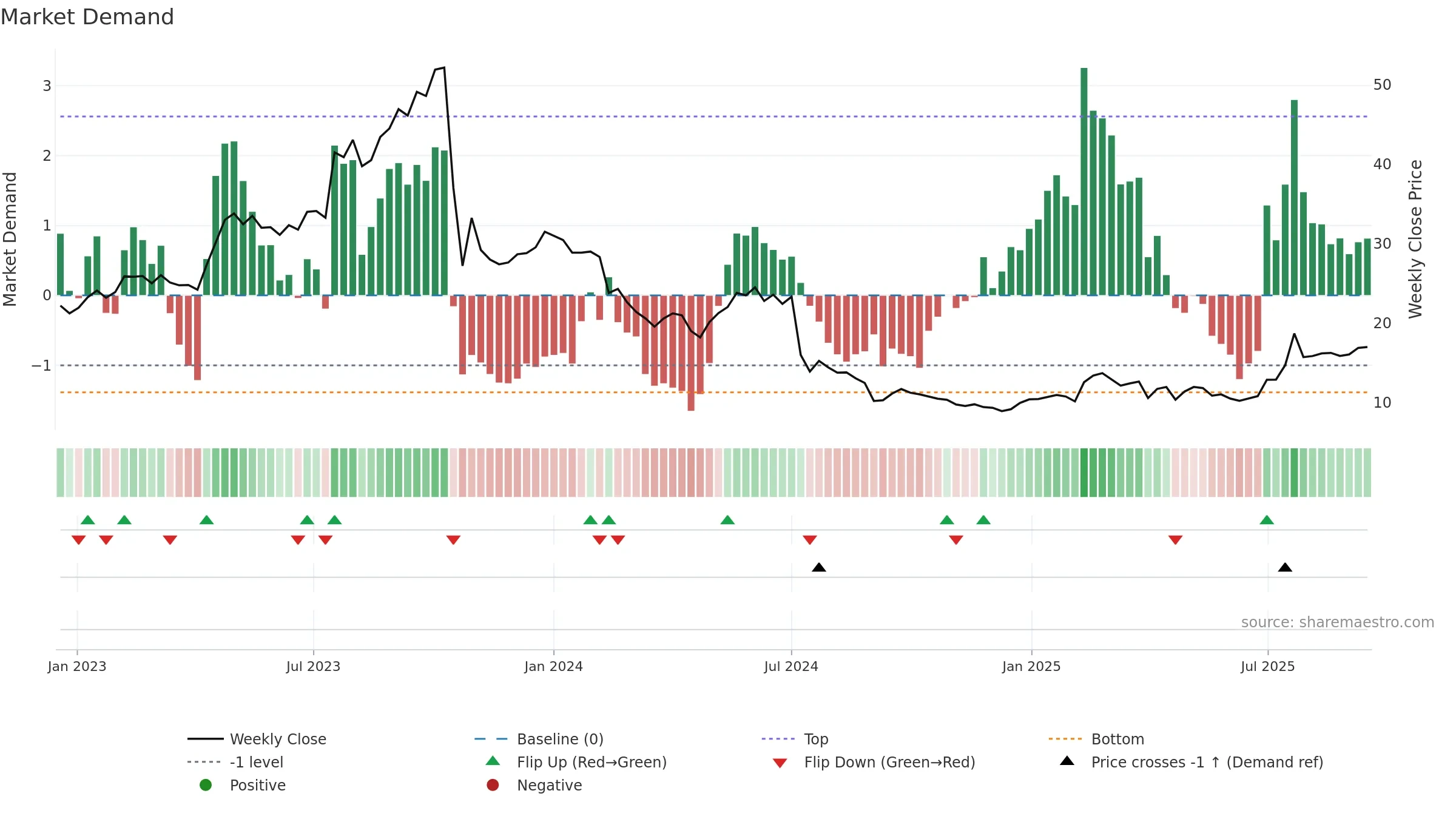

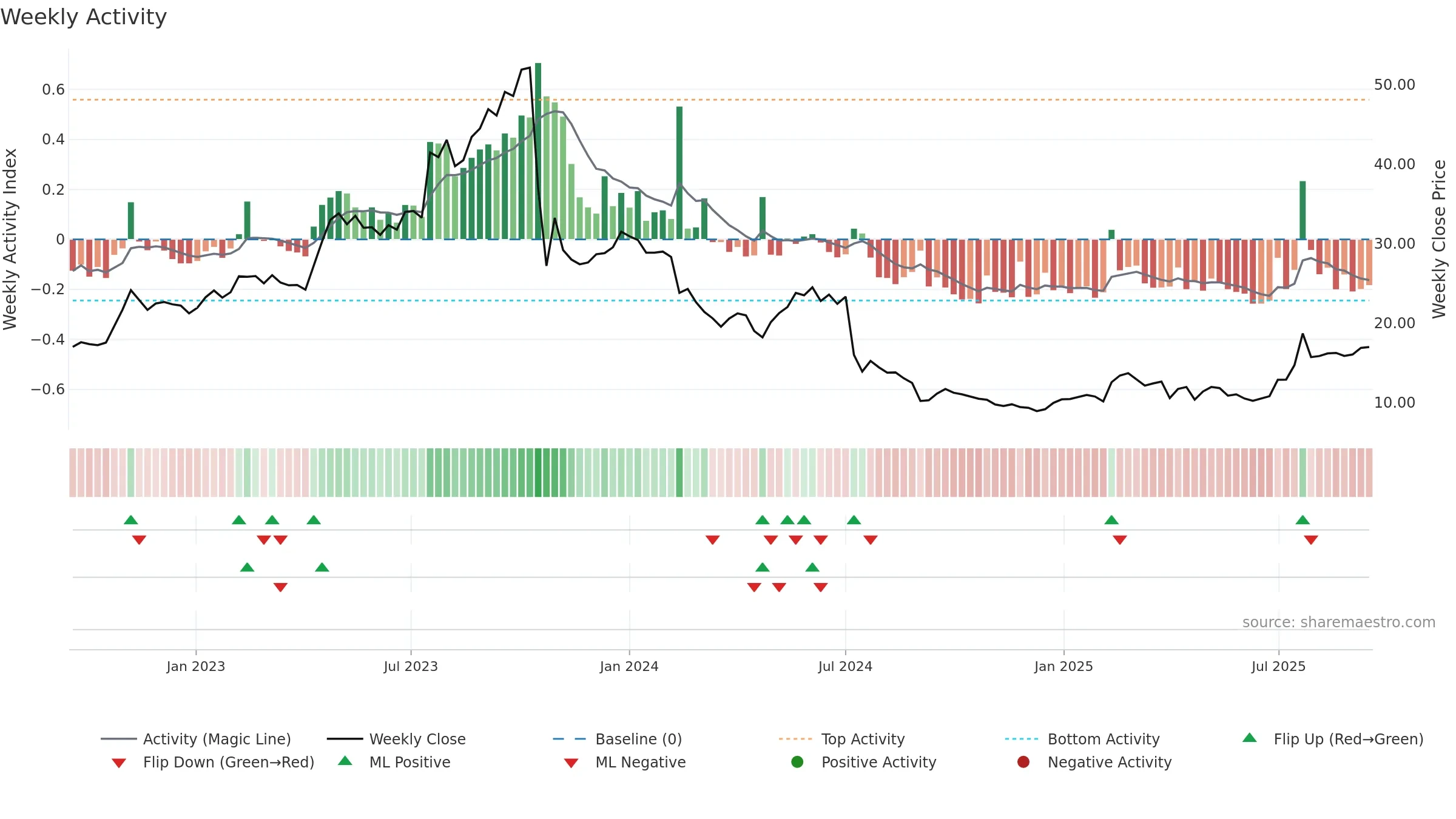

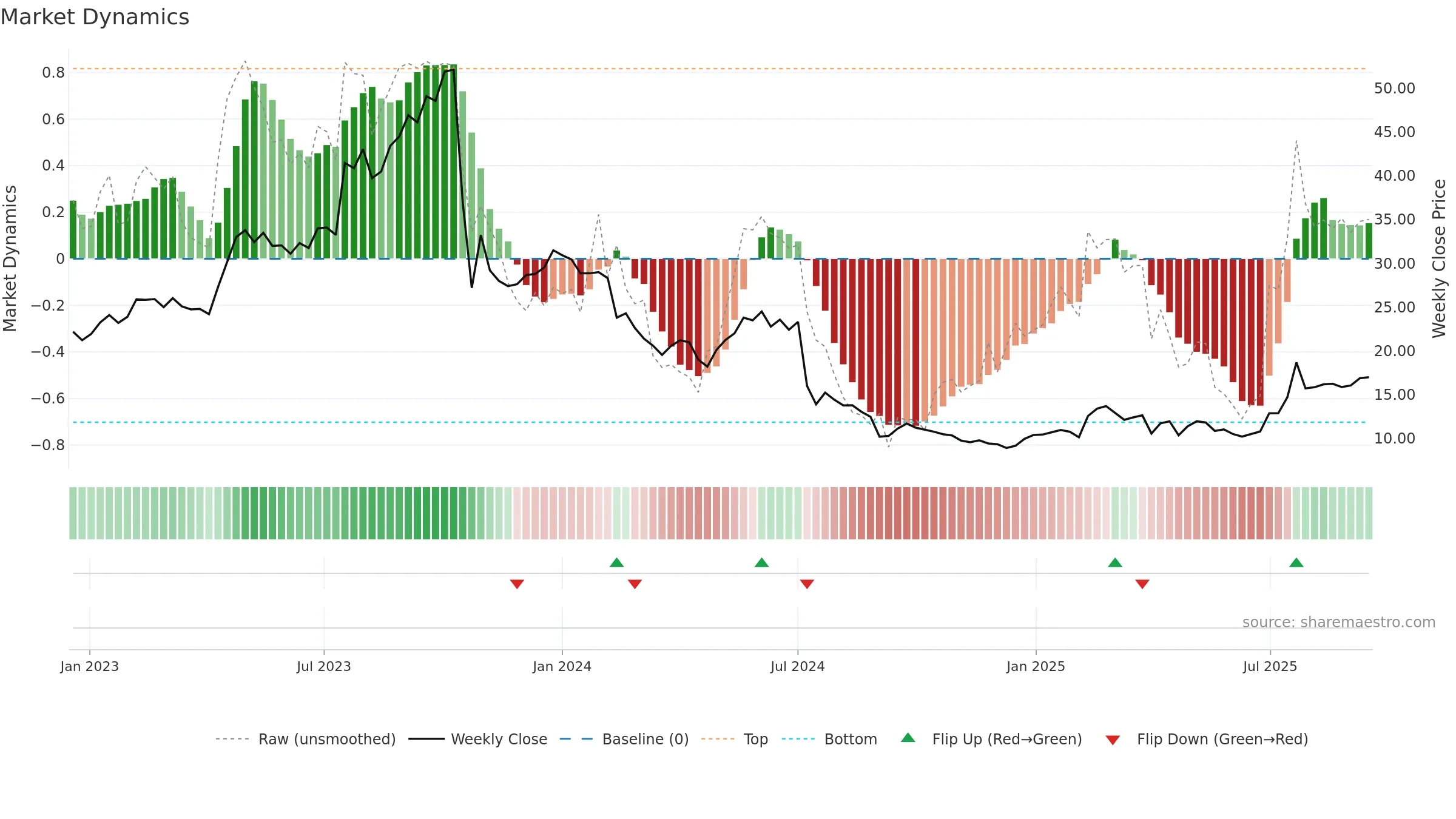

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Fresh short-term crossover improves near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

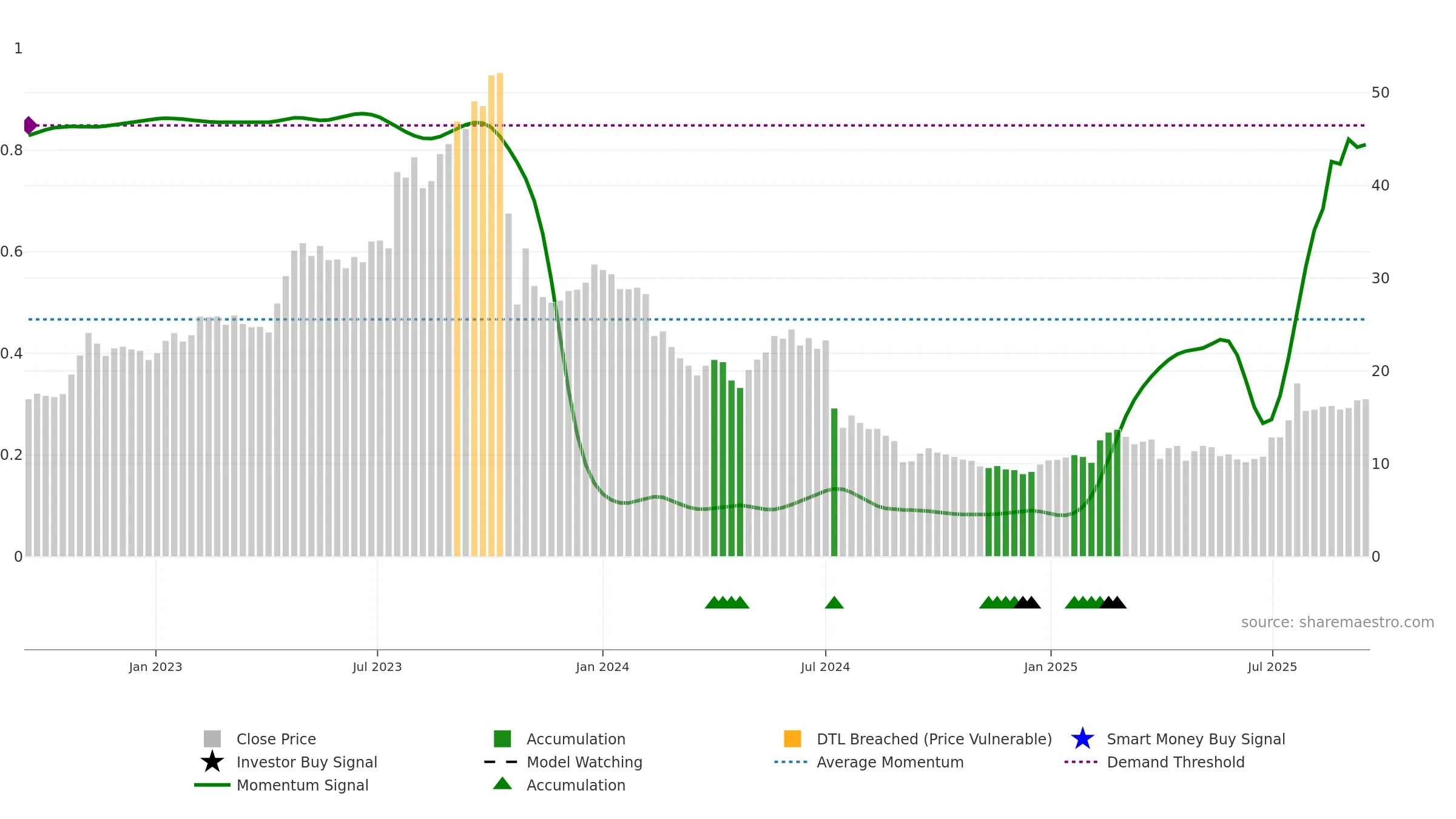

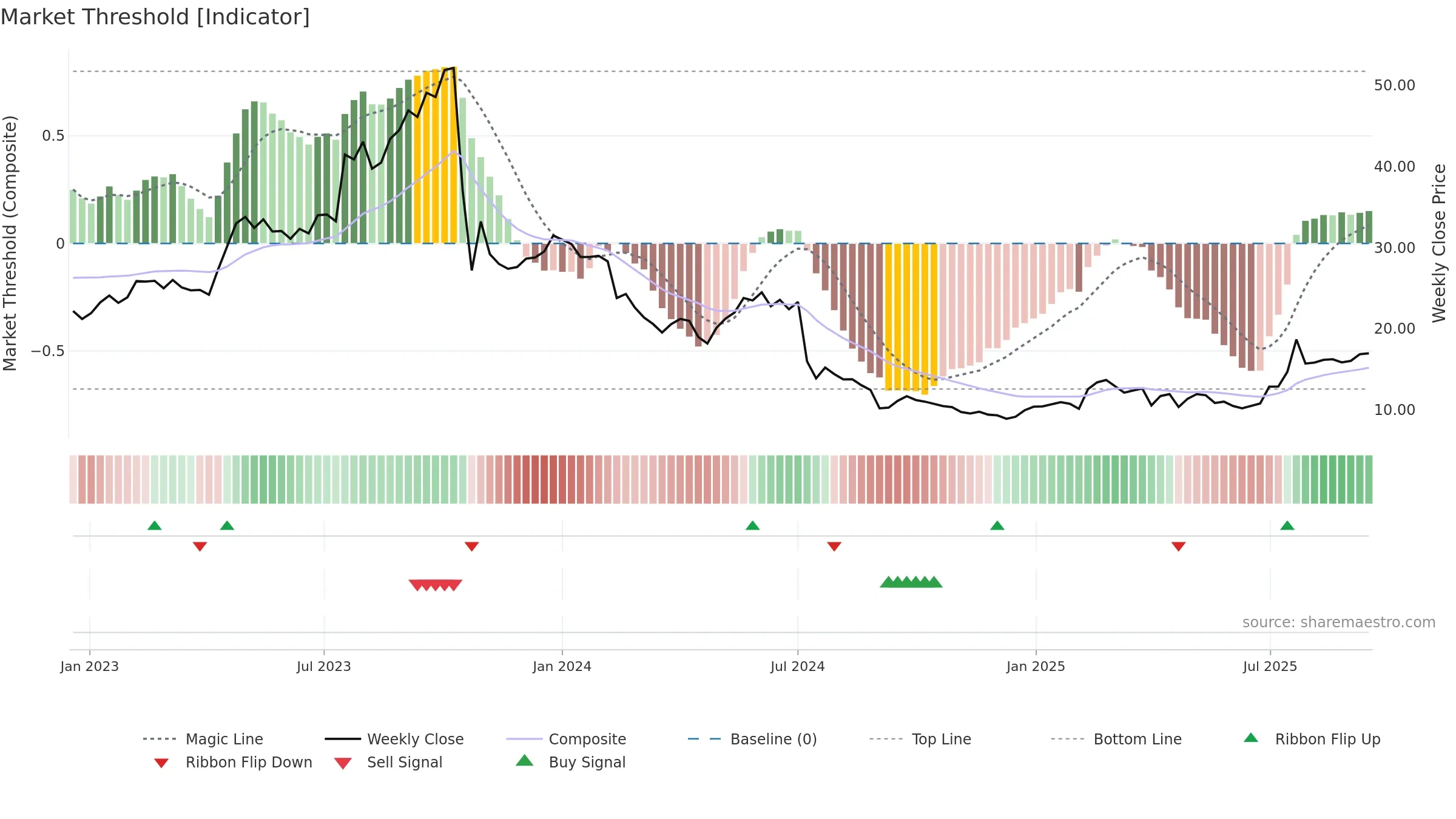

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Price is above fair value; upside may be capped without catalysts.

Conclusion

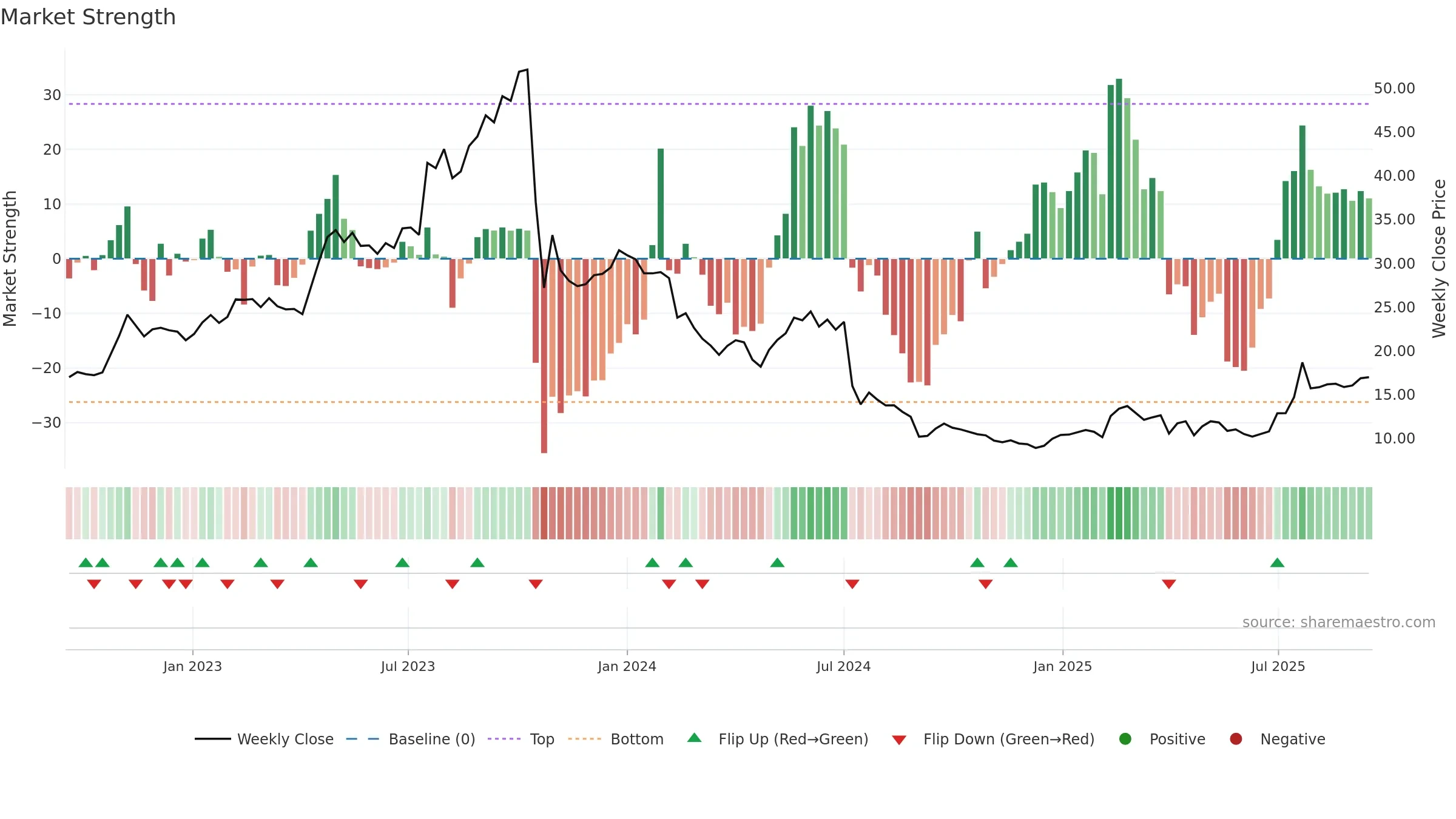

Negative setup. ★★☆☆☆ confidence. Price window: 8. Trend: Range / Neutral; gauge 81. In combination, liquidity diverges from price.

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity diverges from price

- High return volatility raises whipsaw risk

- Sellers active at elevated levels (distribution)

Why: Price window 8.08% over 8w. Close is 0.65% above the prior-window high. Return volatility 5.58%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. High-regime (0.80–1.00) downticks 1/2 (50.0%) • Accumulating. MA stack constructive. 4–8w crossover bullish. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.