CNX Resources Corporation

CNX NYSE

Weekly Report

CNX Resources Corporation closed at 30.3600 (-0.59% WoW) . Data window ends Fri, 19 Sep 2025.

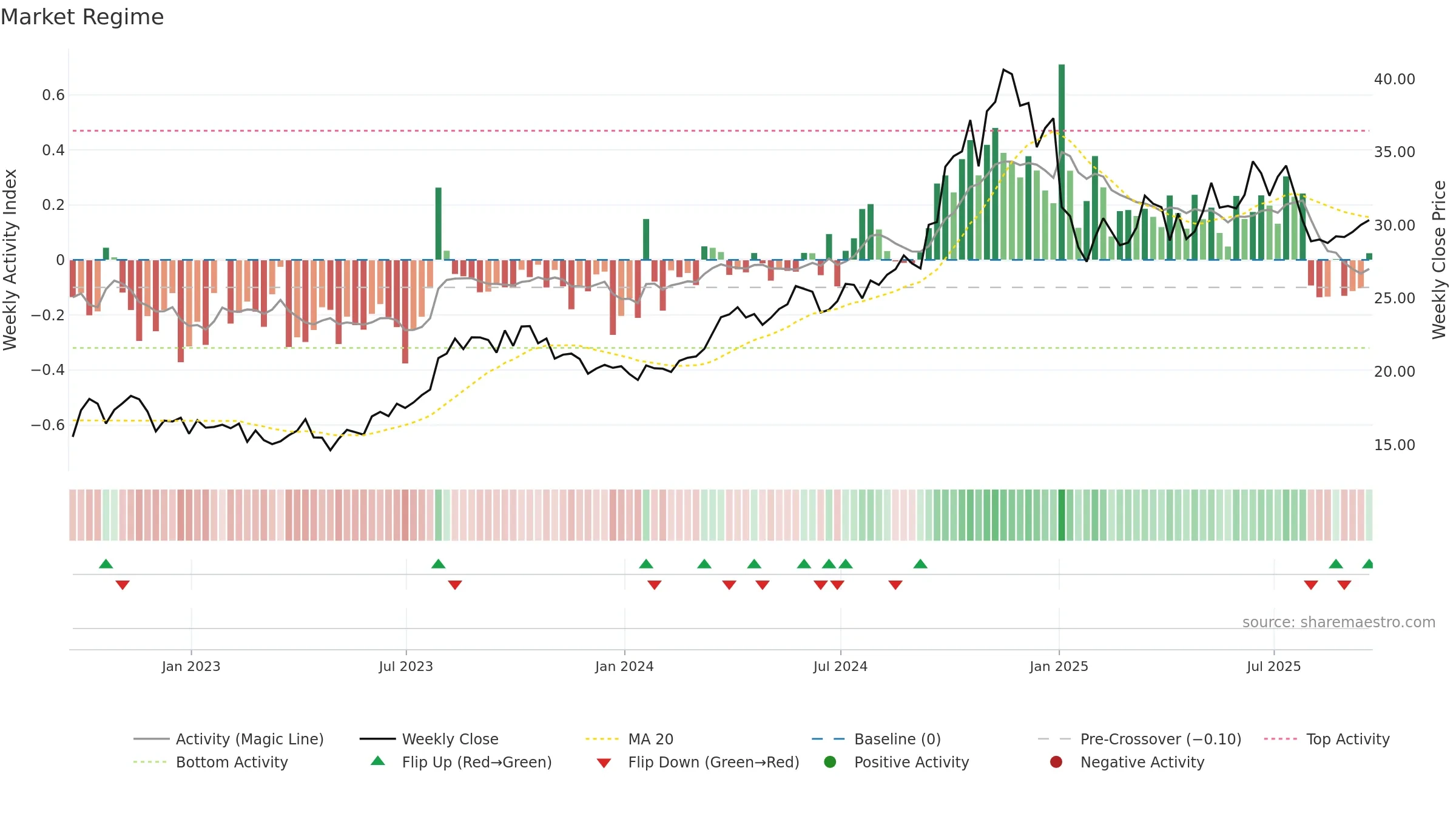

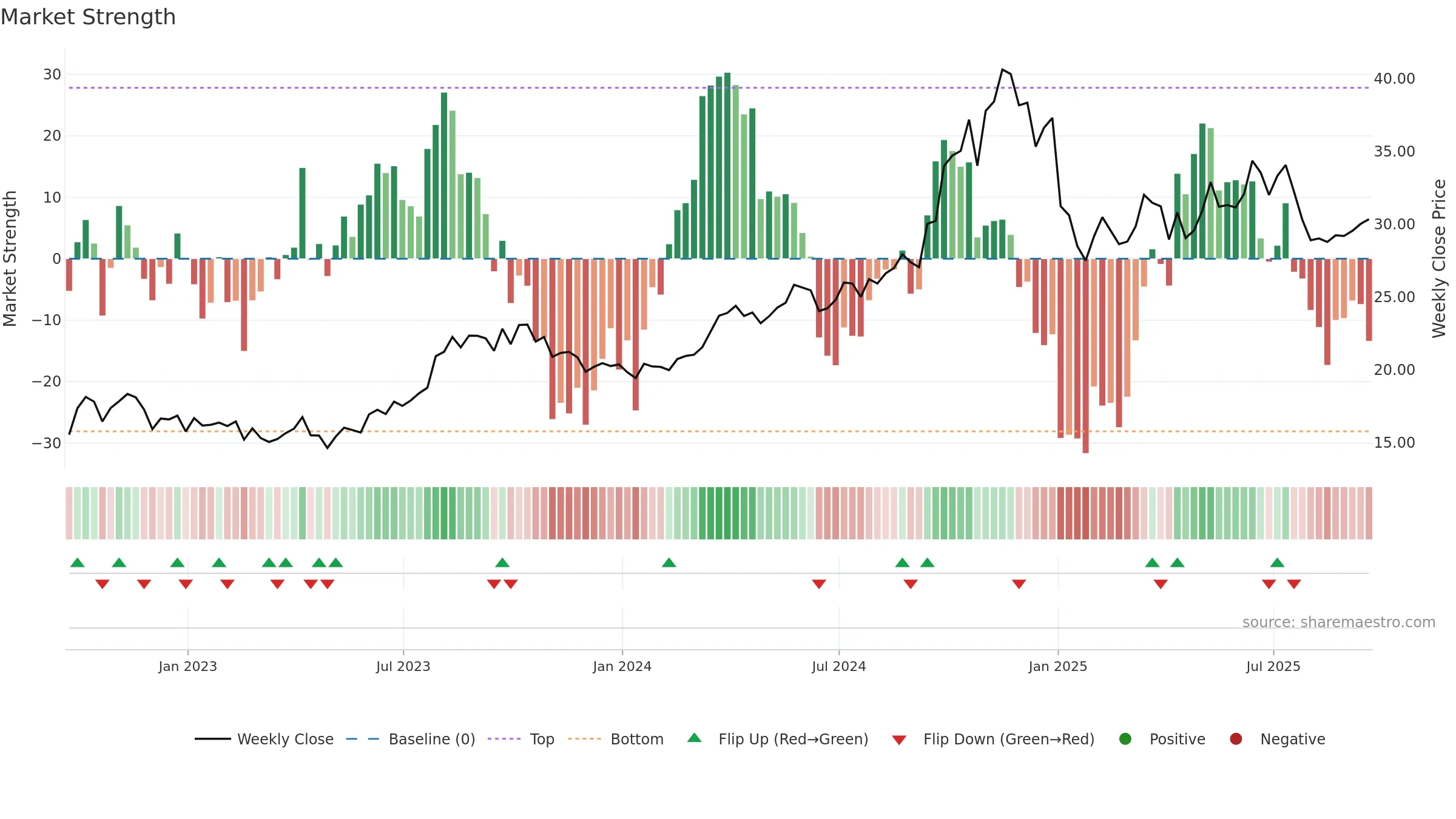

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Distance to baseline is narrowing — reverting closer to its fair-value track.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

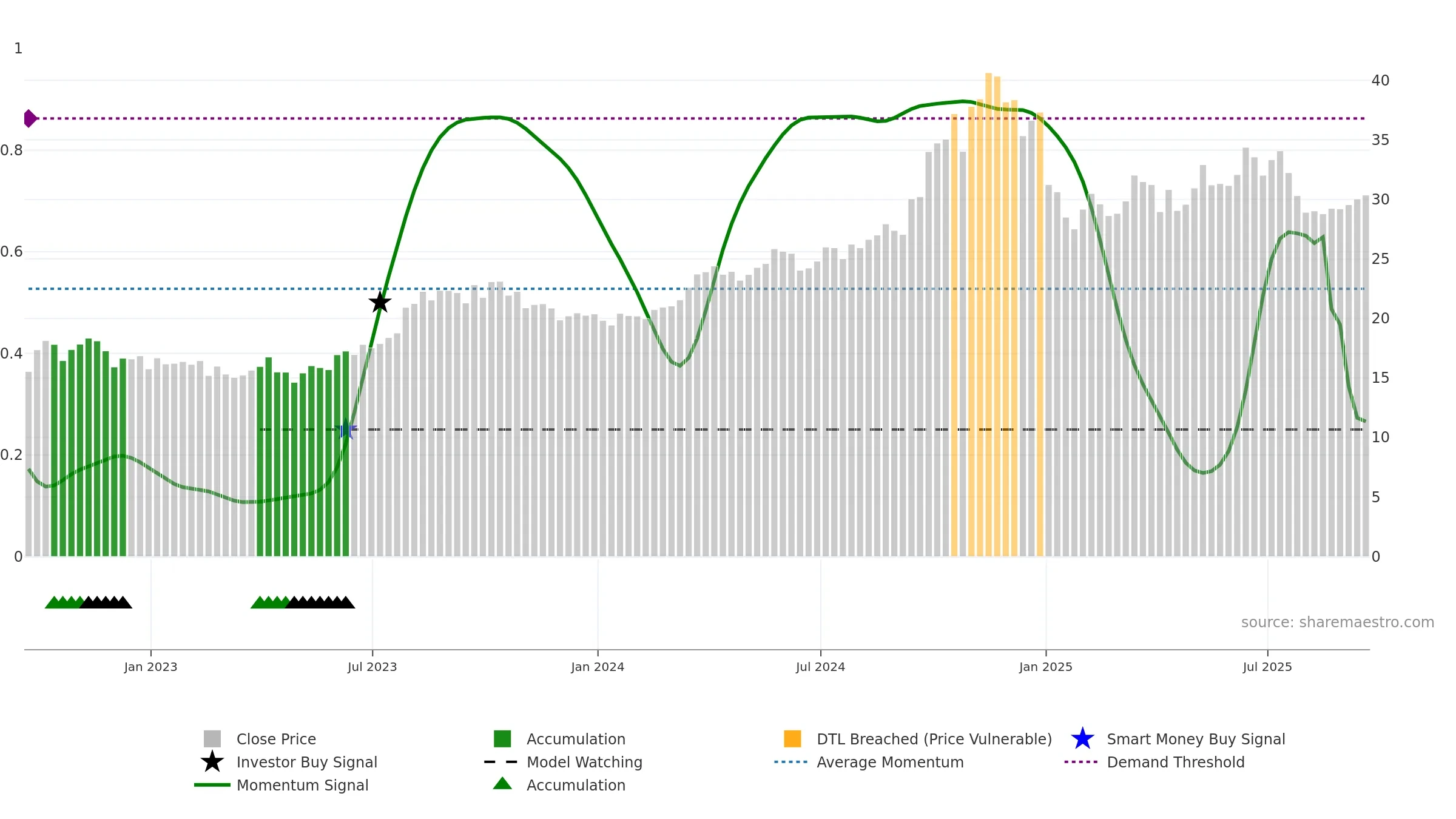

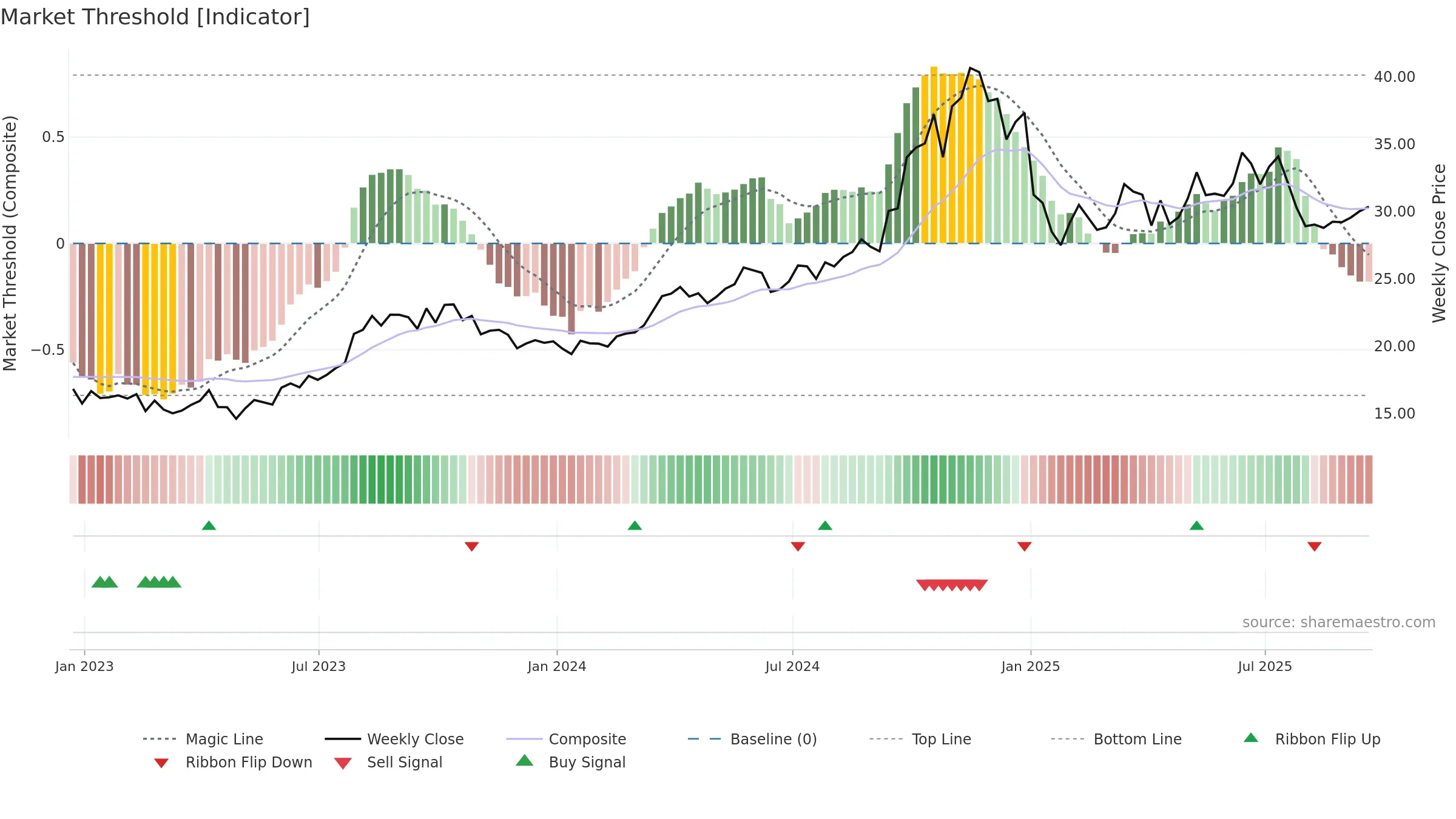

Gauge maps the trend signal to a 0–100 scale.

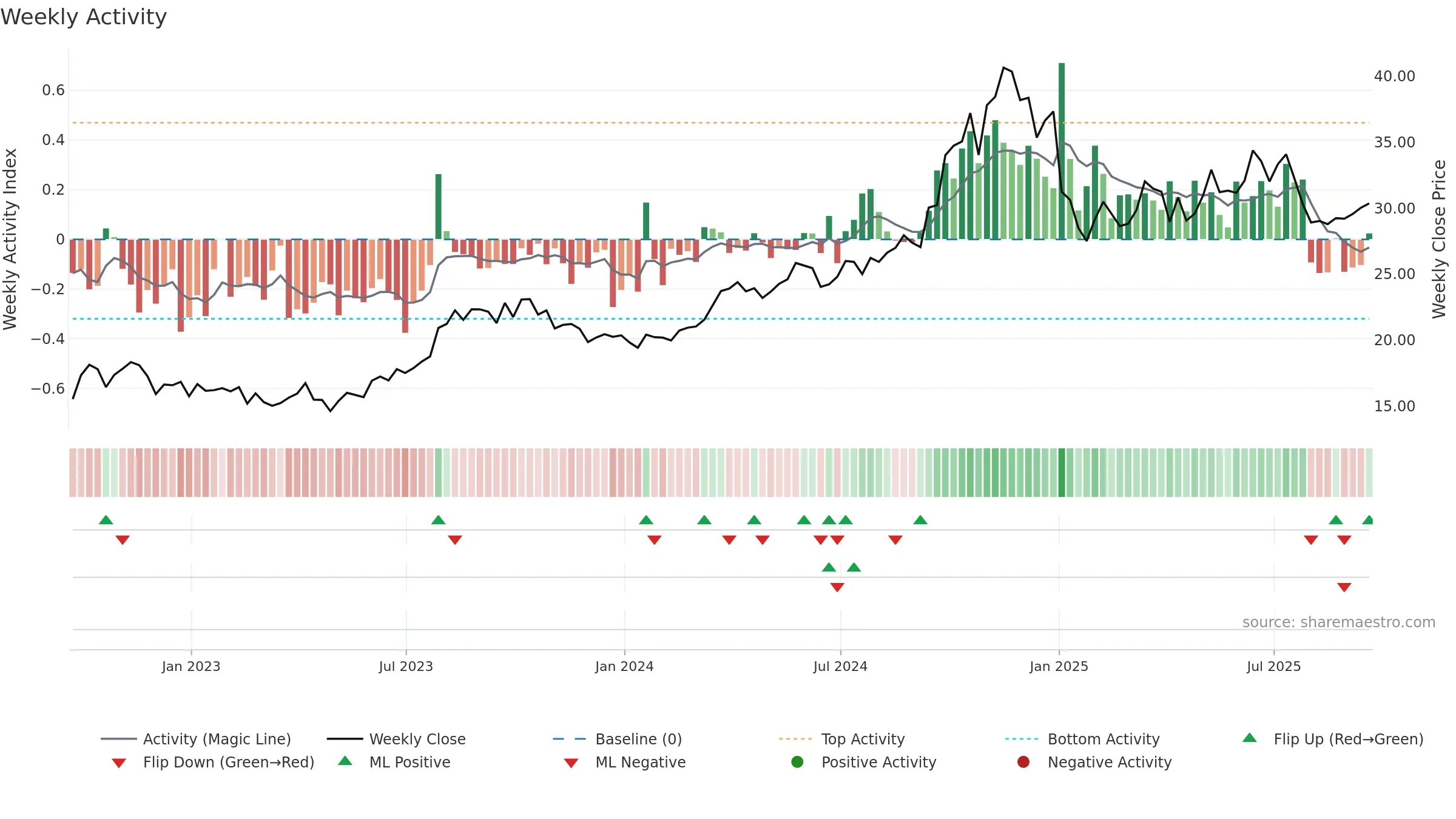

How to read this — Bearish zone with falling momentum — sellers in control. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Price is below fair value; potential upside if momentum constructive.

Conclusion

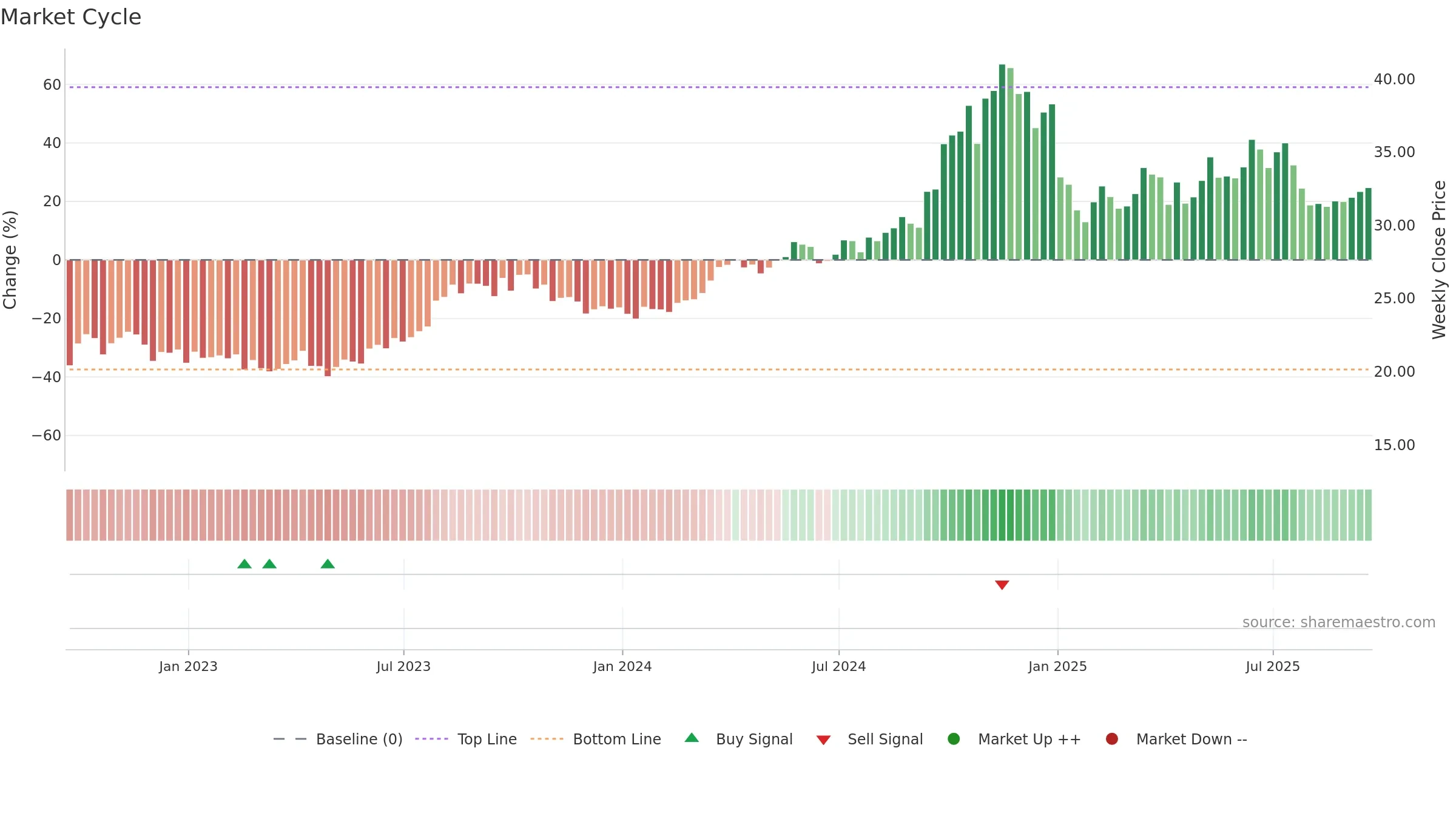

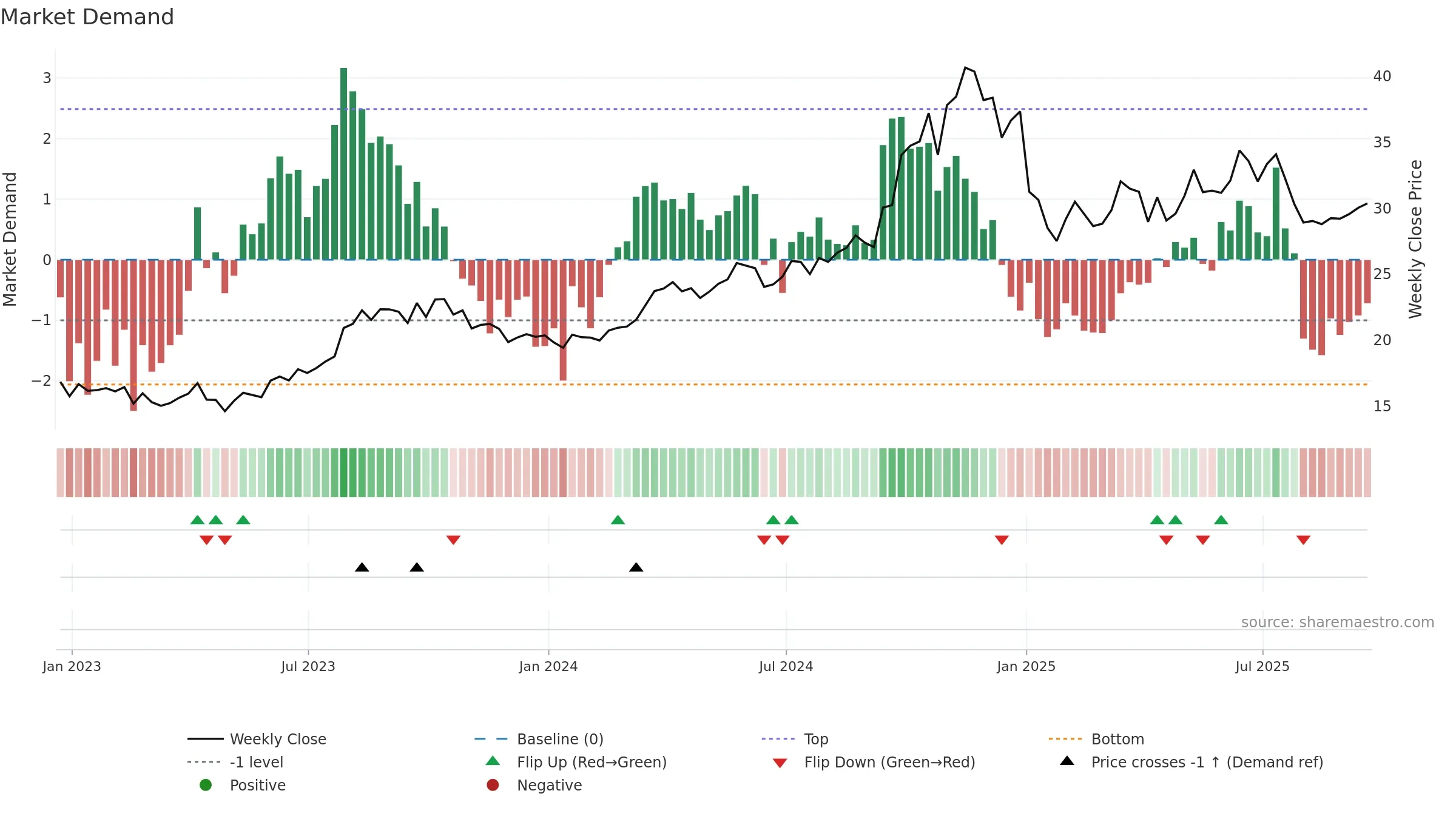

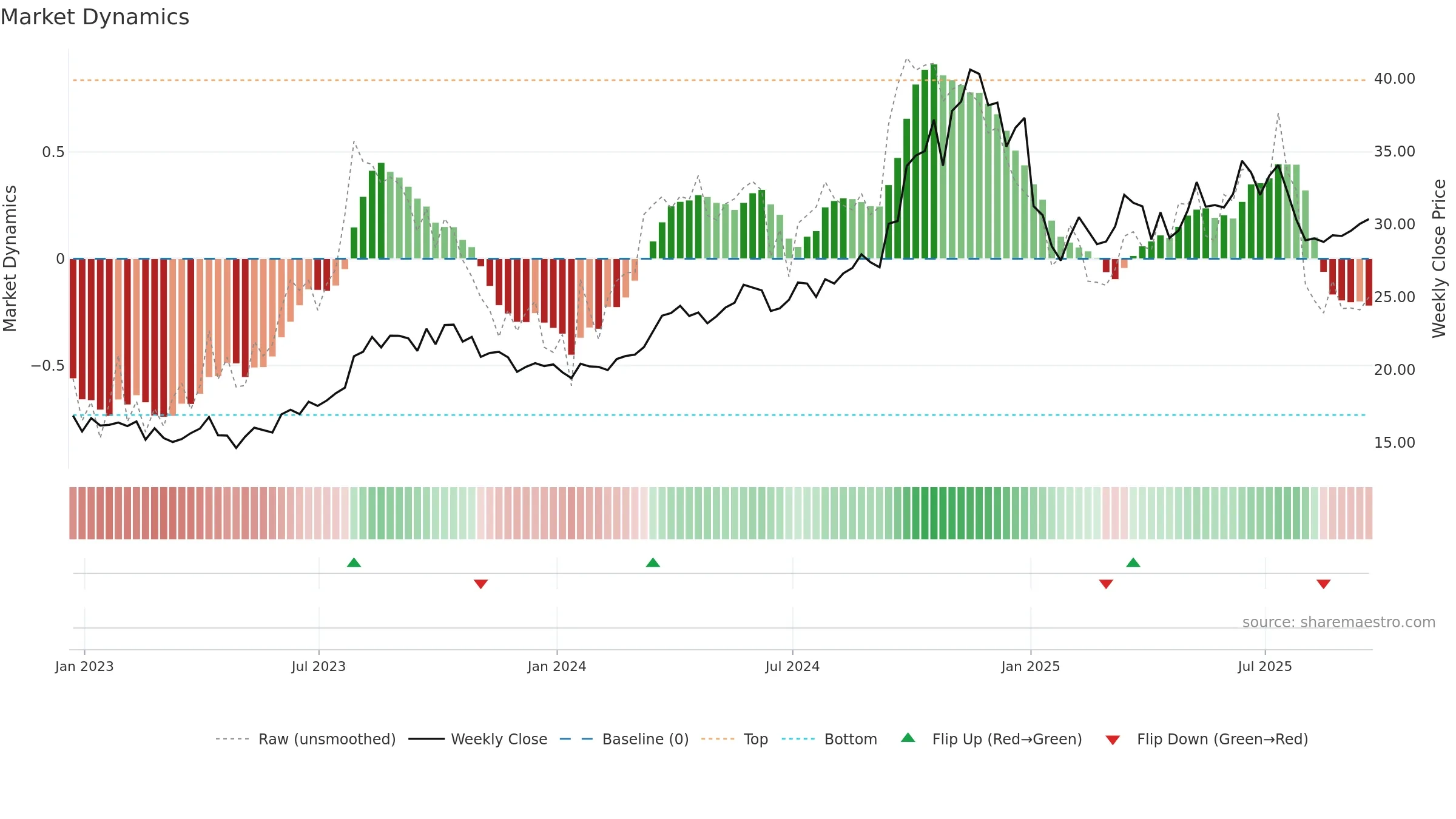

Negative setup. ★★☆☆☆ confidence. Price window: 5. Trend: Downtrend Confirmed; gauge 26. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Sub-0.40 print confirms bear control

Why: Price window 5.02% over 8w. Close is 1.10% above the prior-window high. Return volatility 1.82%. Volume trend rising. Liquidity convergence with price. Trend state downtrend confirmed. Momentum bearish and falling. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.