Ero Copper Corp.

ERO NYSE

Weekly Report

Ero Copper Corp. closed at 16.9700 (0.77% WoW) . Data window ends Fri, 19 Sep 2025.

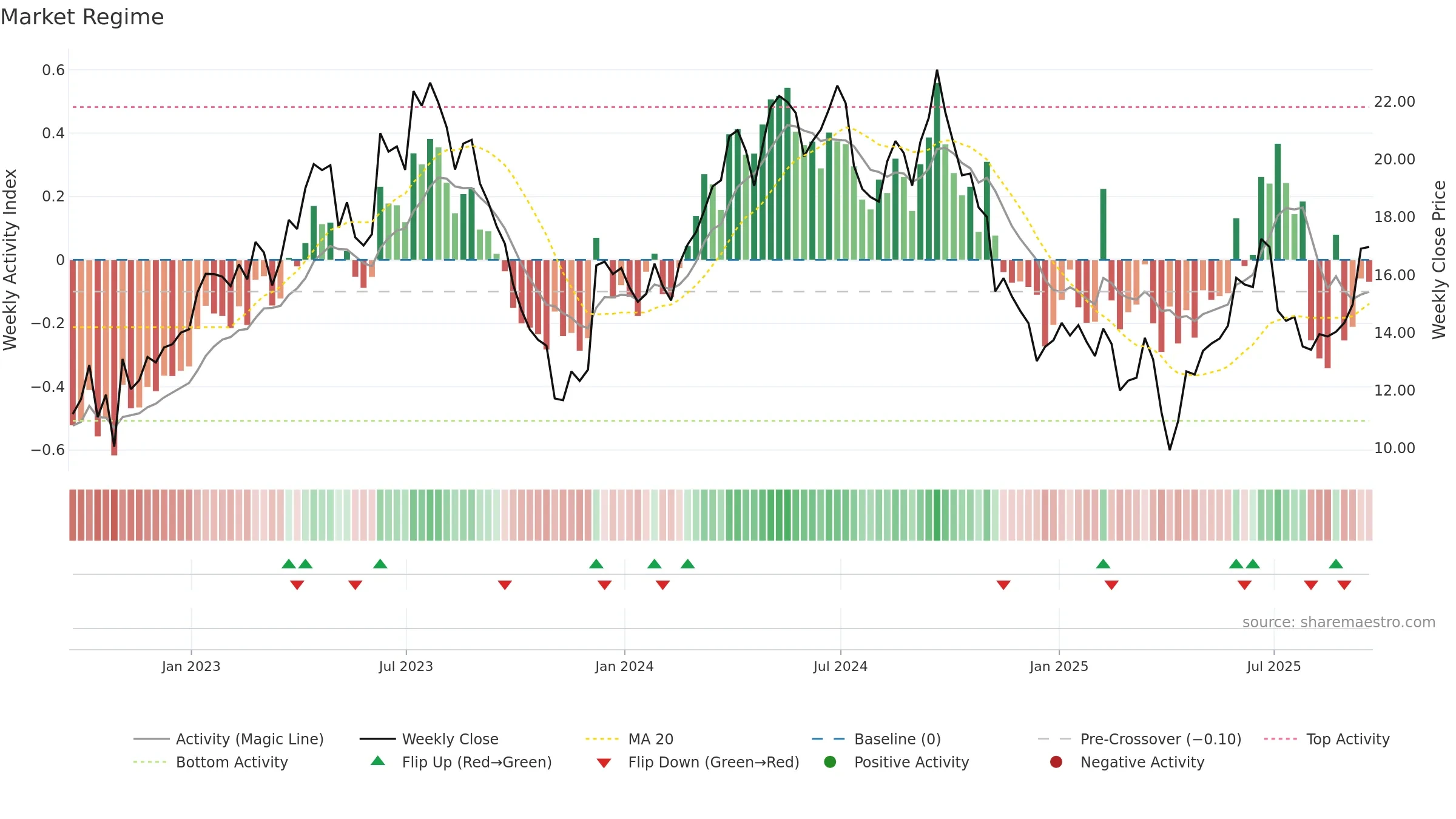

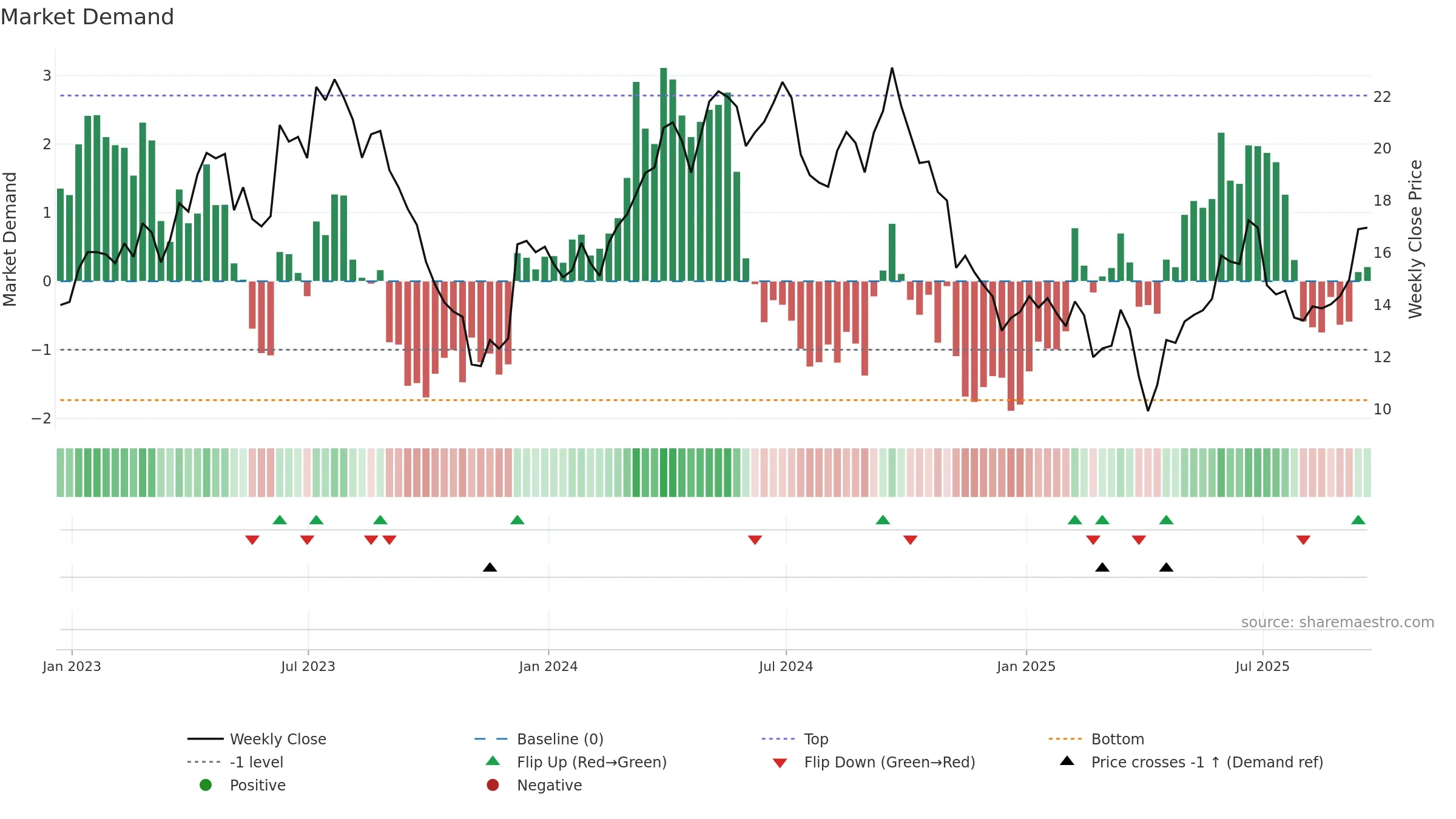

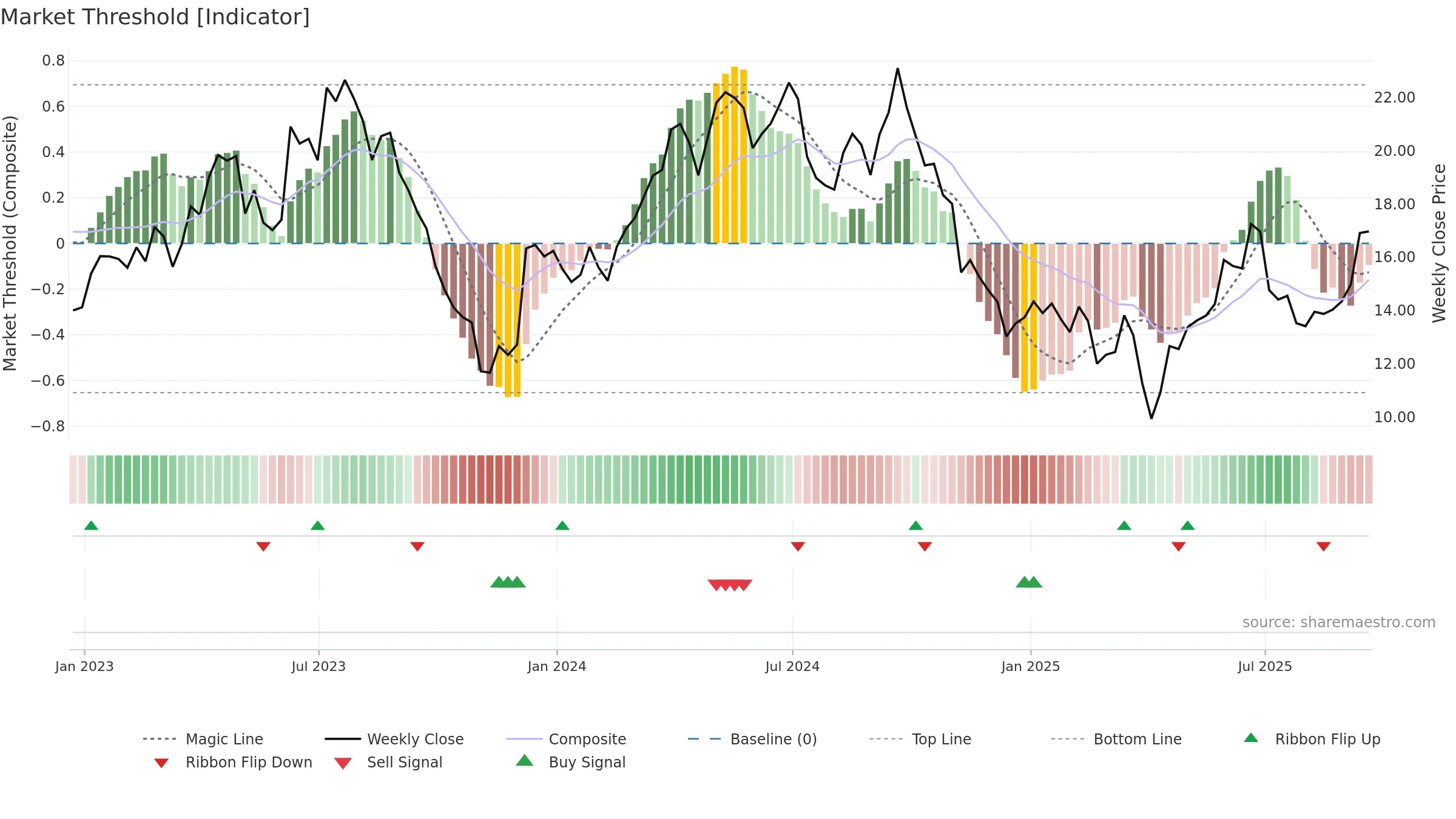

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Price is stretched above its baseline; consolidation risk rises if activity fades. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

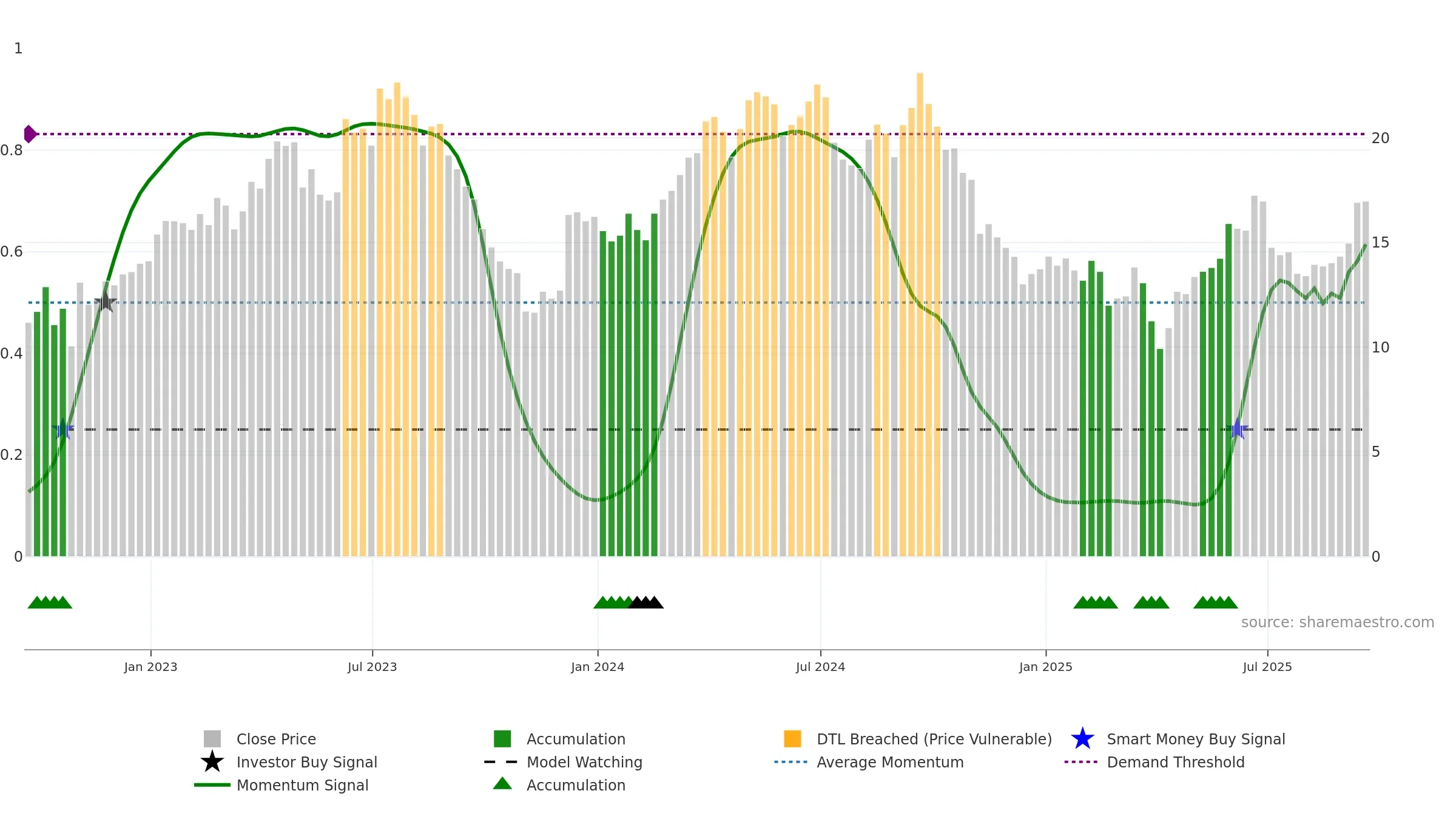

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

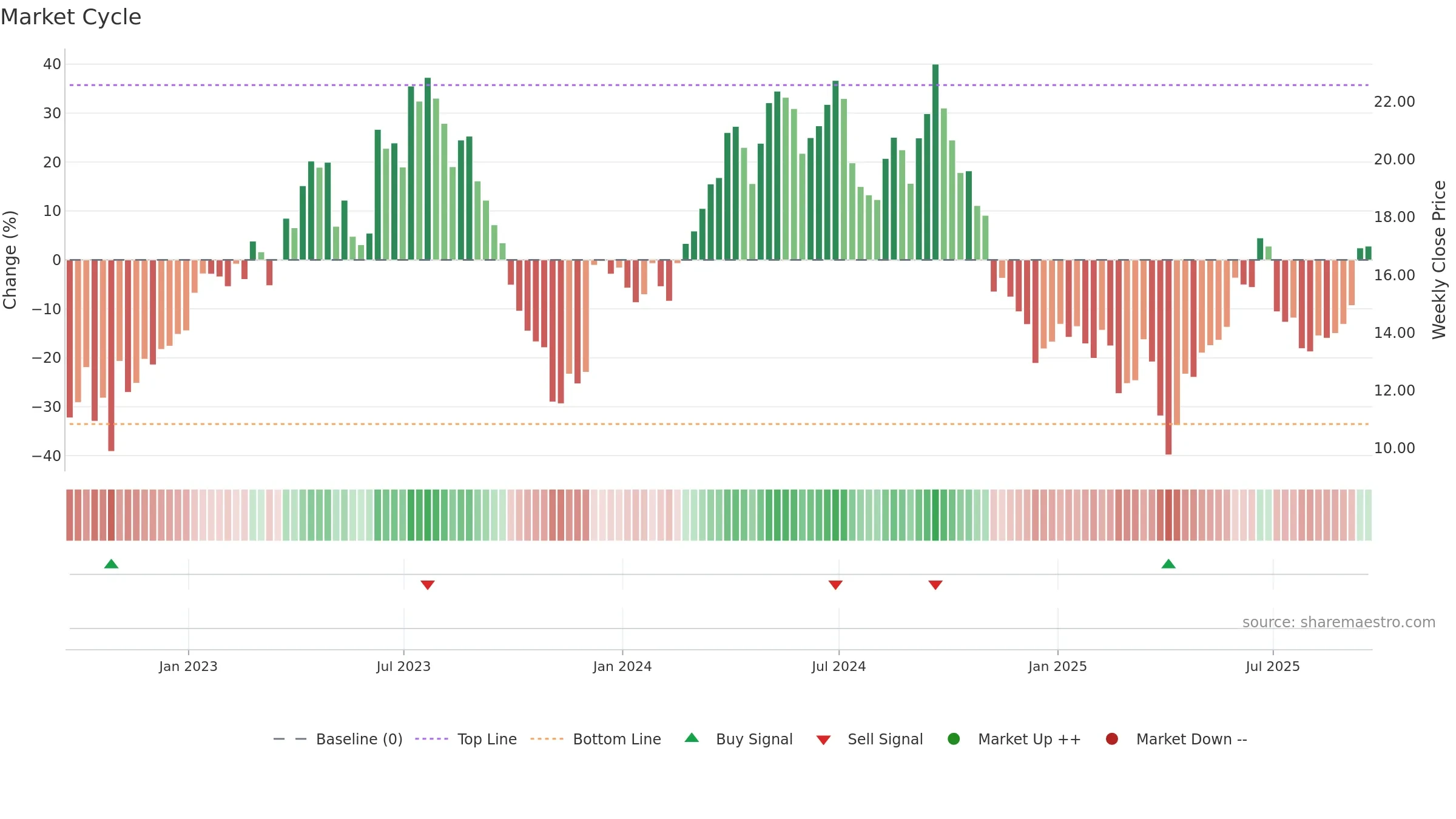

Positive setup. ★★★★☆ confidence. Price window: 26. Trend: Strong Uptrend; gauge 61. In combination, liquidity diverges from price.

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Low return volatility supports durability

- Liquidity diverges from price

Why: Price window 26.55% over 8w. Return volatility 0.93%. Volume trend falling. Liquidity divergence with price. Trend state strong uptrend. Momentum bullish and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.