Polaris Inc.

PII NYSE

Weekly Summary

Polaris Inc. closed at 55.3600 (-2.60% WoW) . Data window ends Fri, 19 Sep 2025.

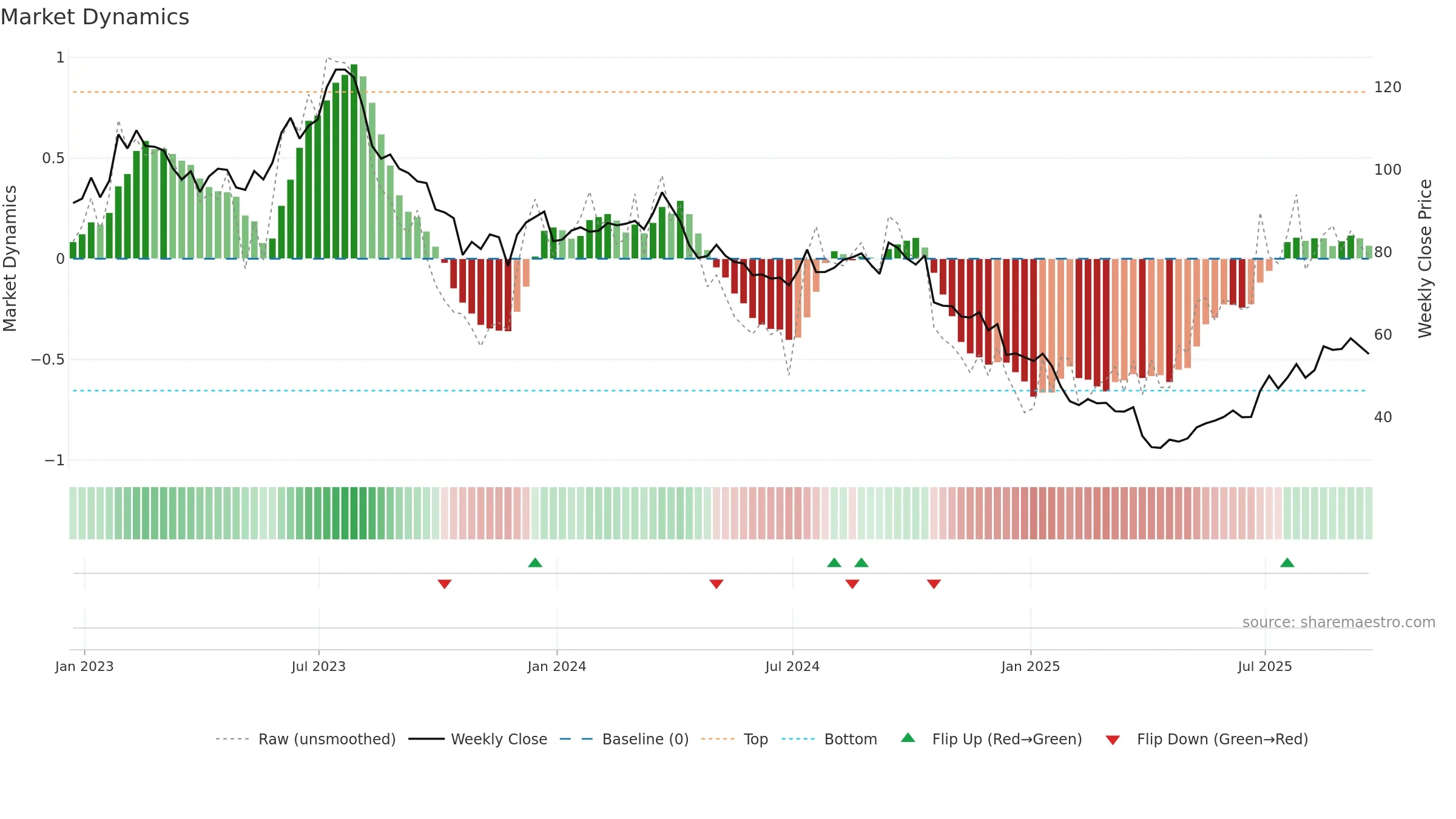

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

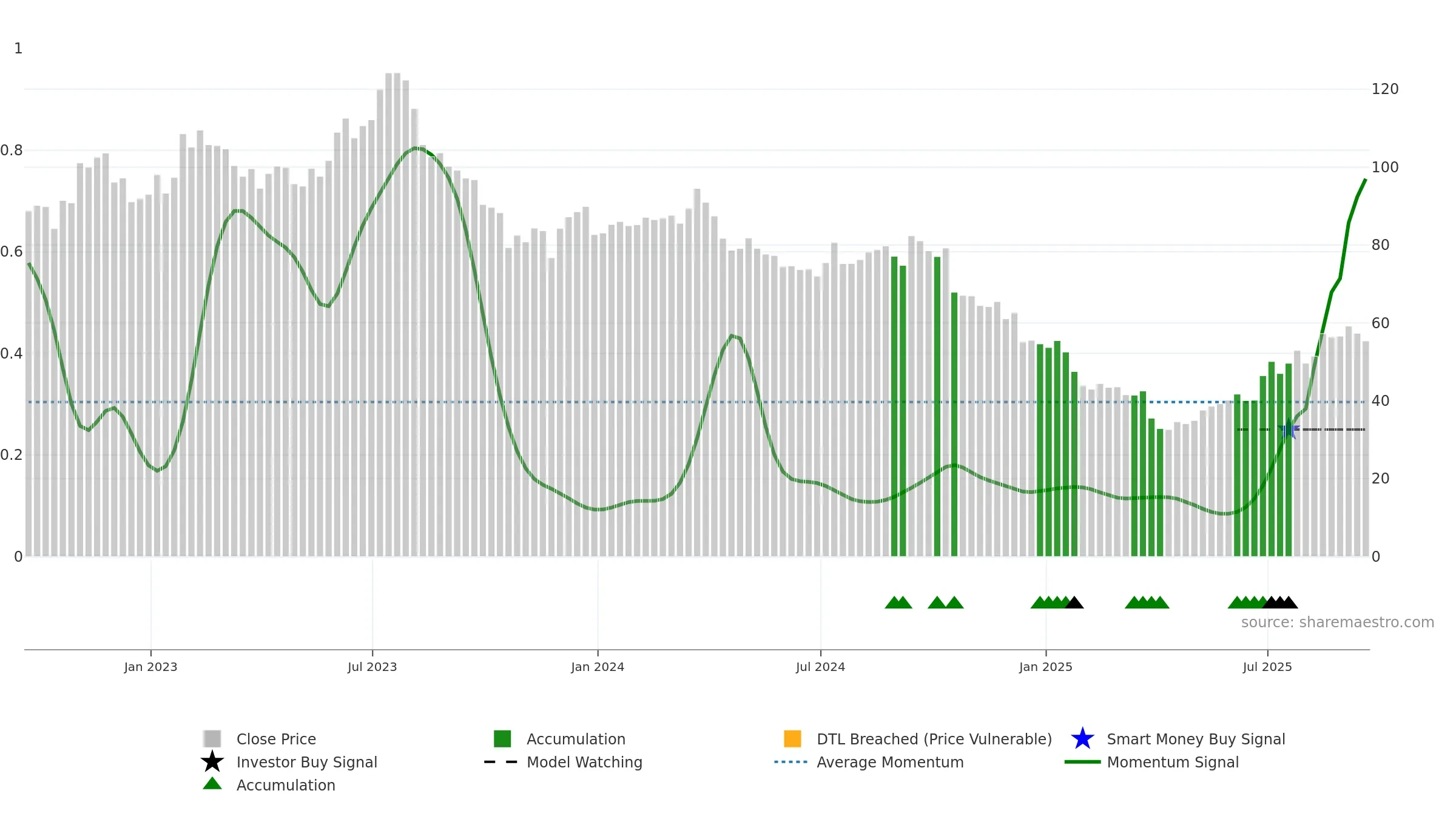

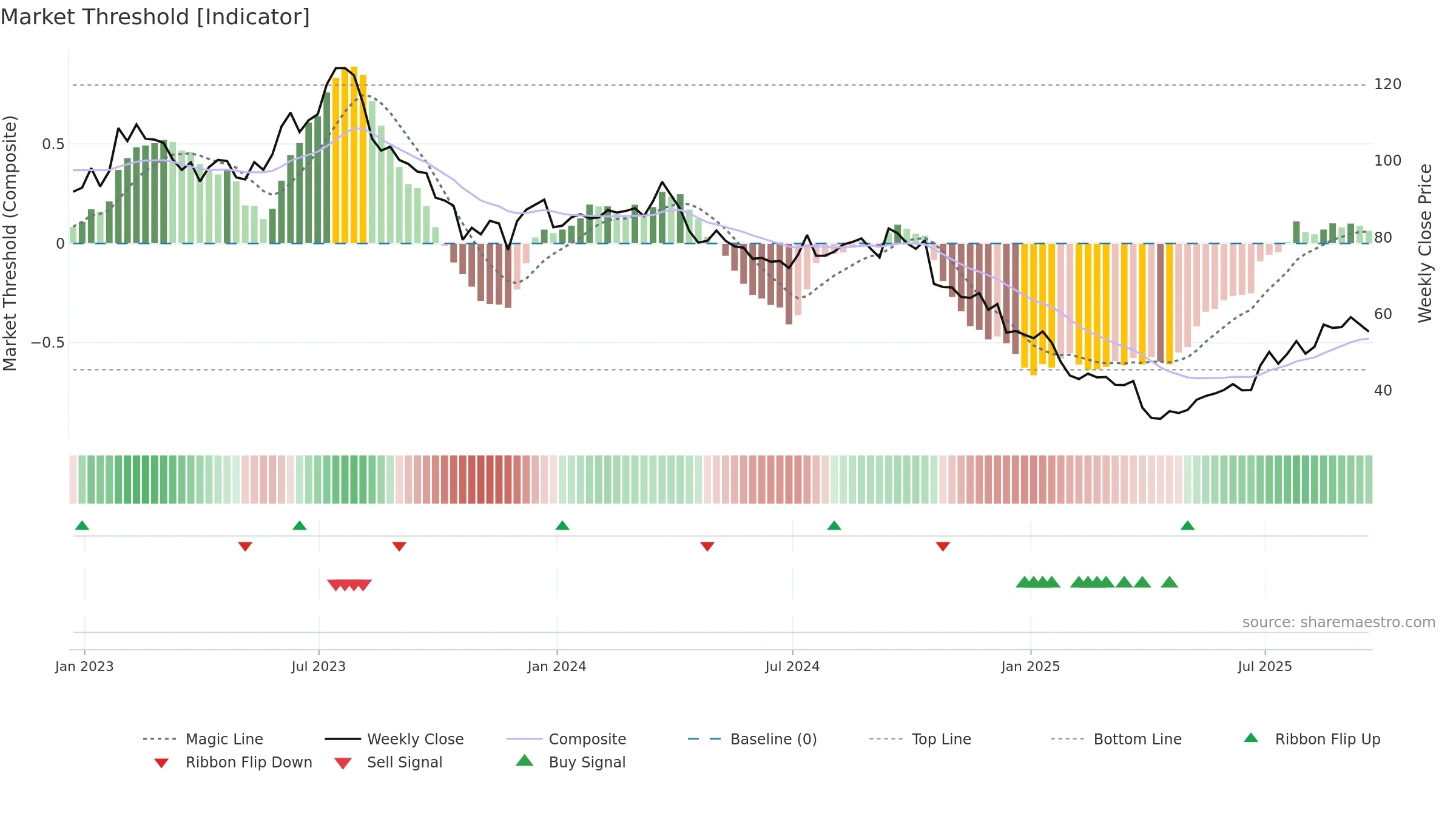

Gauge maps the trend signal to a 0–100 scale.

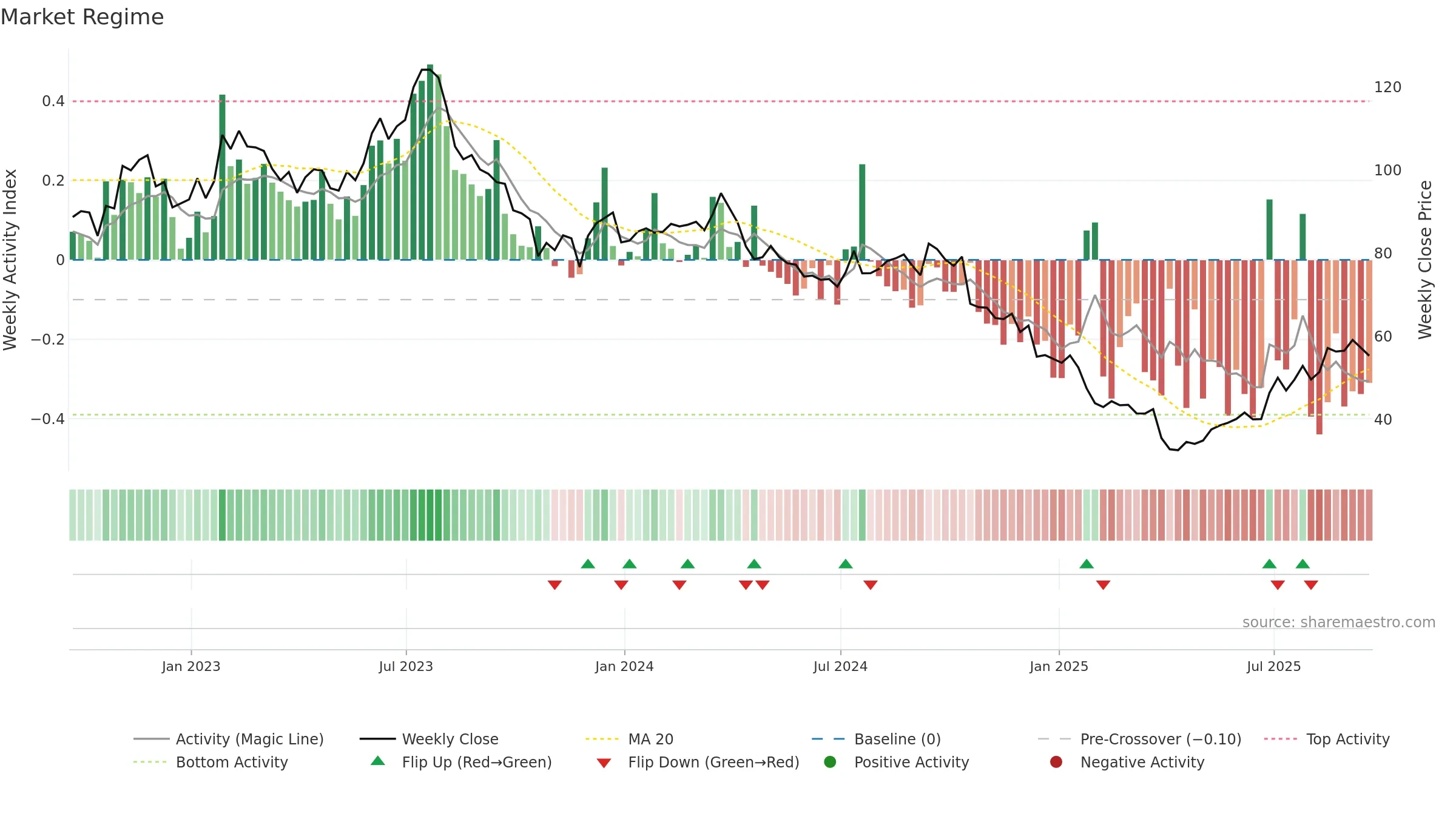

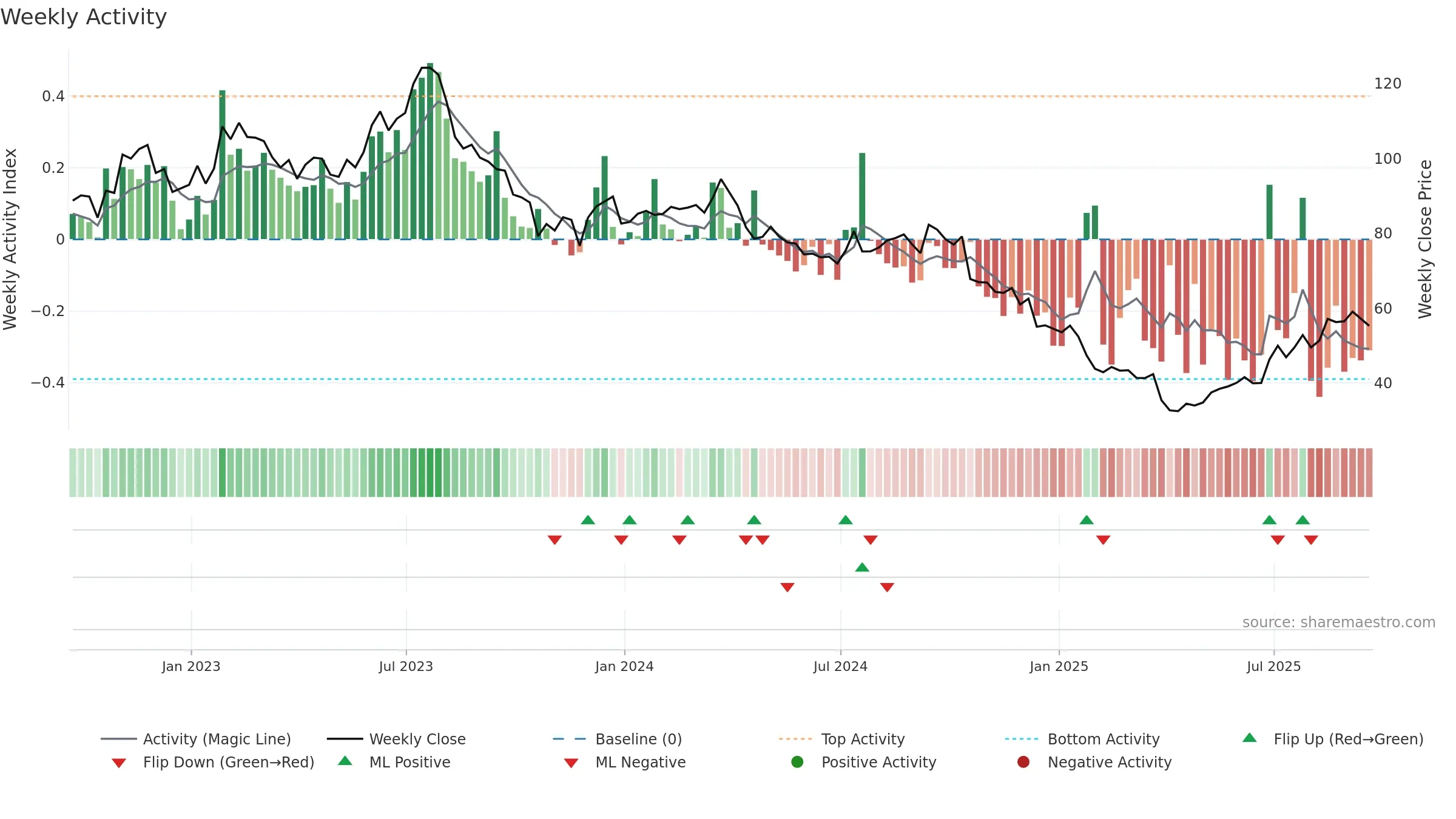

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

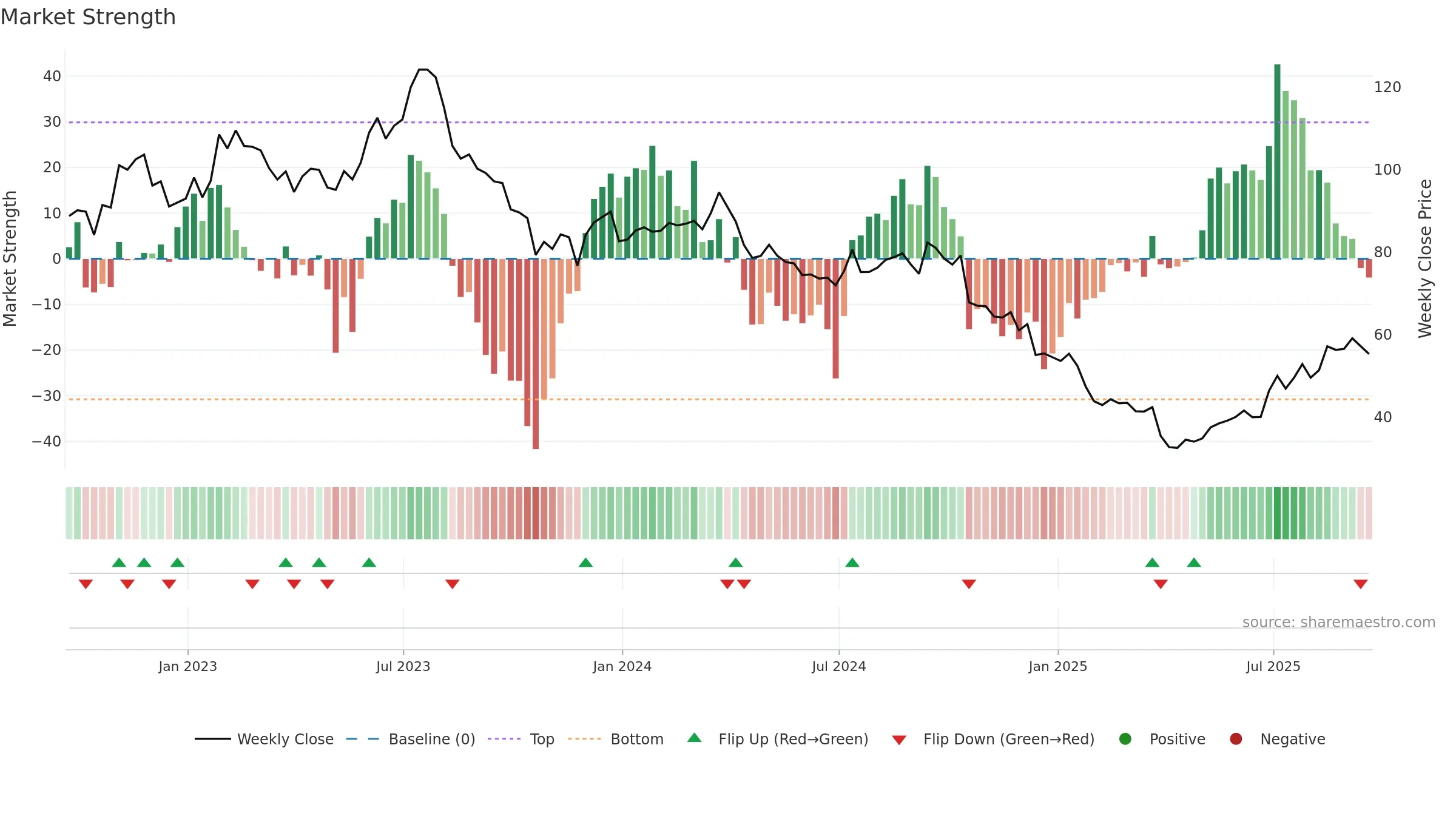

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 9.72% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

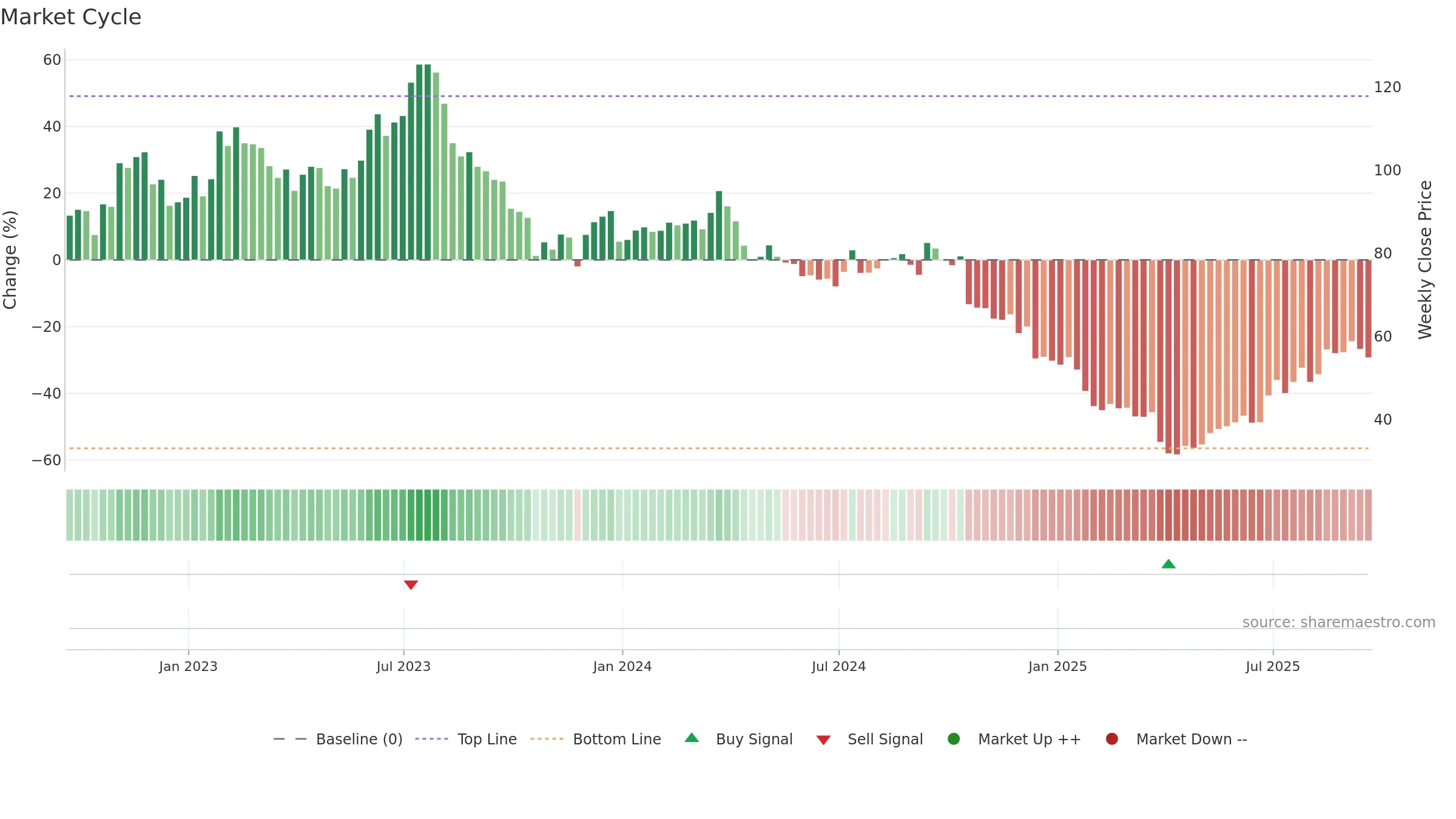

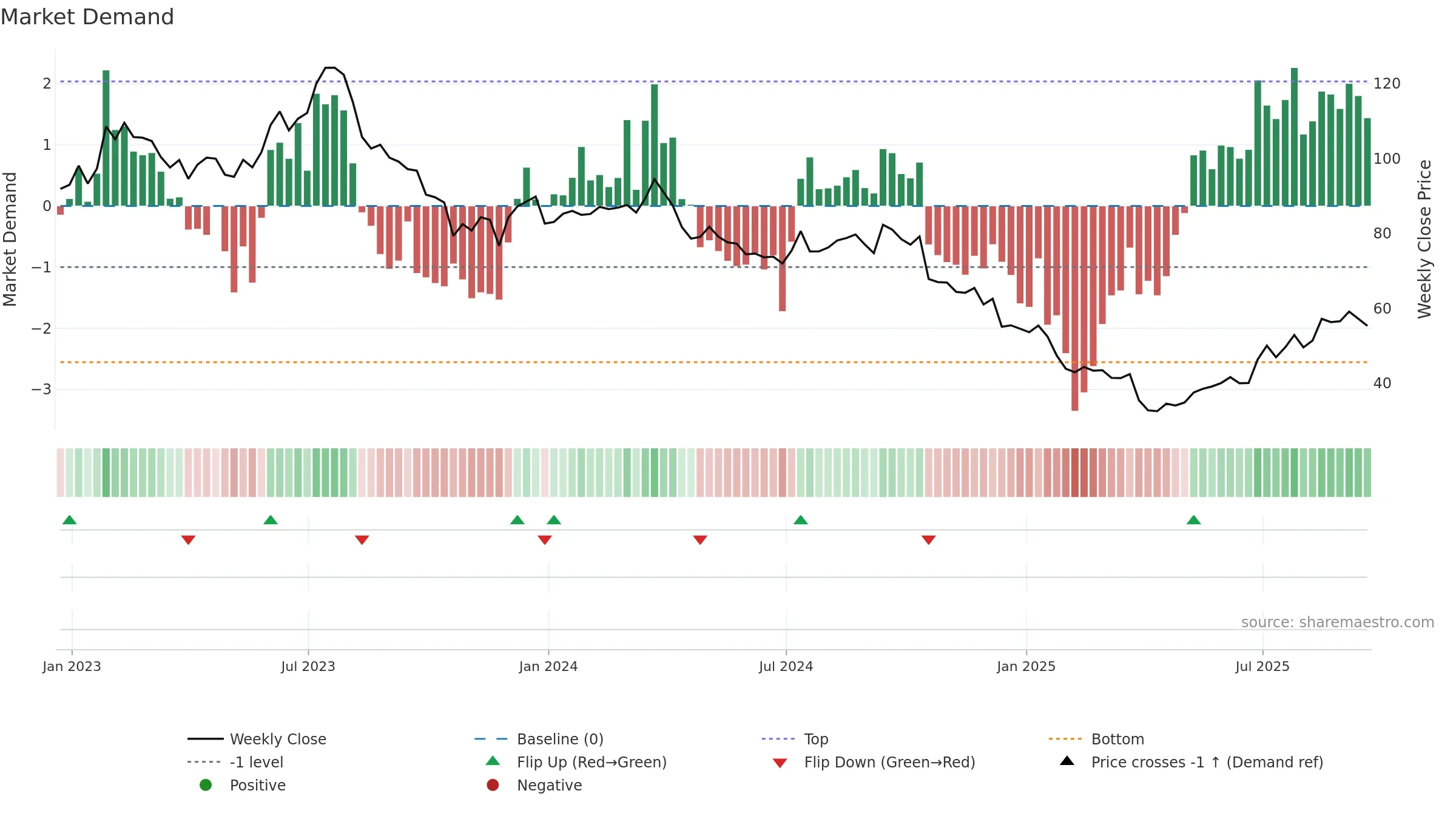

Positive setup. ★★★★⯪ confidence. Trend: Range / Neutral · 11.57% over window · vol 3.12% · liquidity convergence · posture mixed · RS outperforming

- Momentum is bullish and rising

- Constructive moving-average stack

- Liquidity confirms the price trend

- Solid multi-week performance

- Price is not above key averages

Why: Price window 11.57% over w. Close is -6.42% below the prior-window high. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. MA stack constructive. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.