SSAB AB (publ)

SSABBH HEL

Weekly Report

SSAB AB (publ) closed at 4.8840 (1.03% WoW) . Data window ends Mon, 15 Sep 2025.

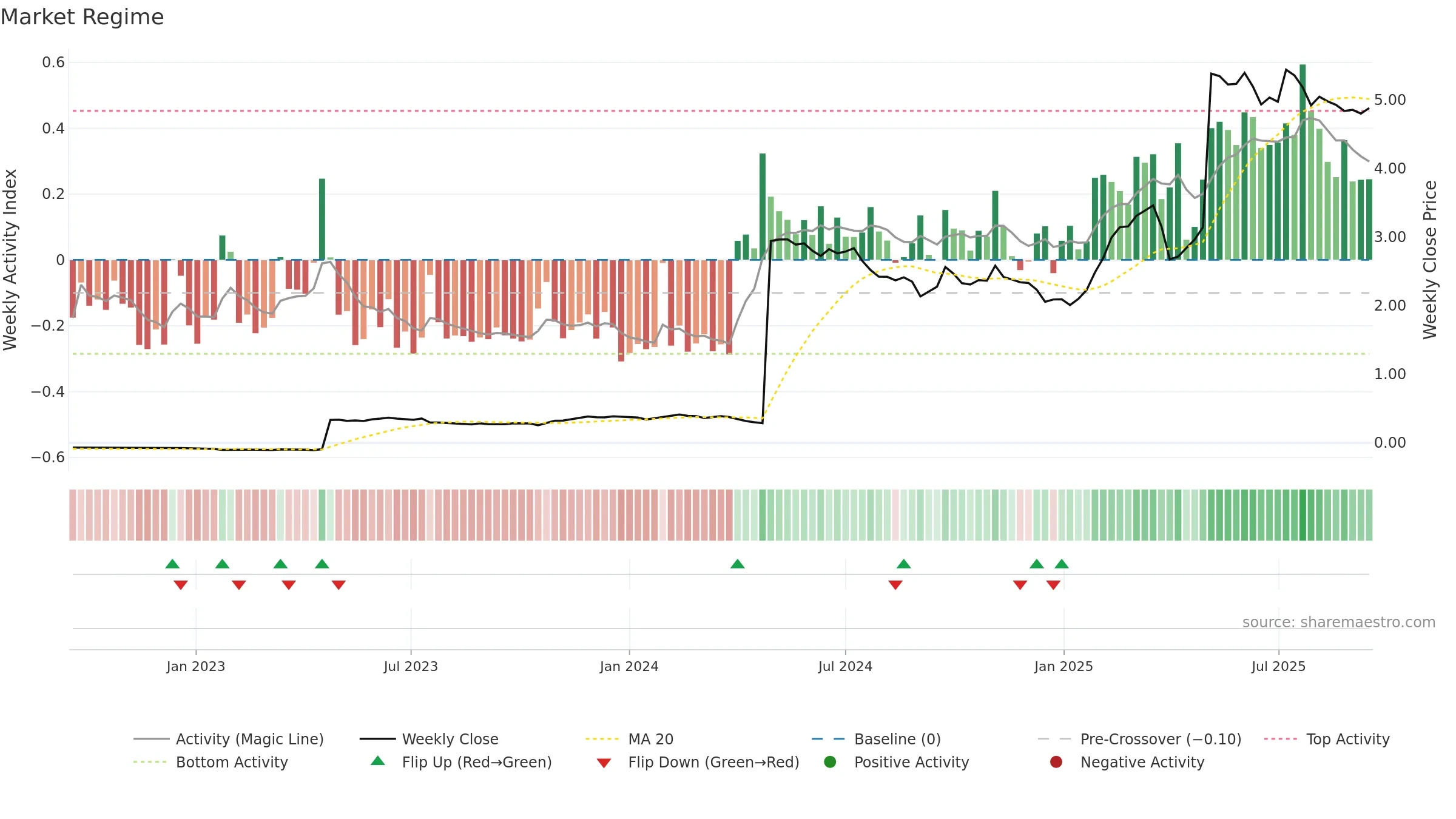

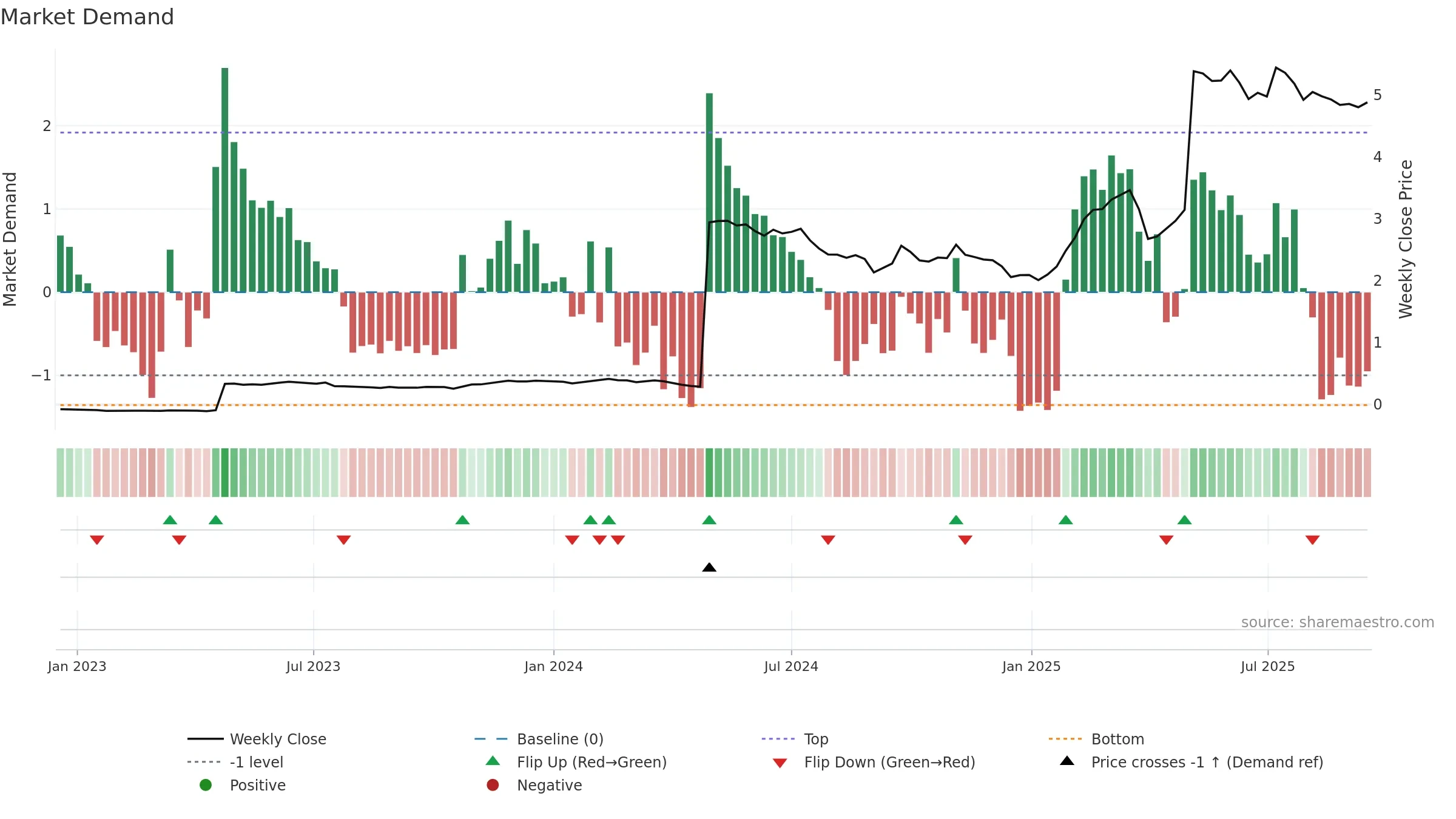

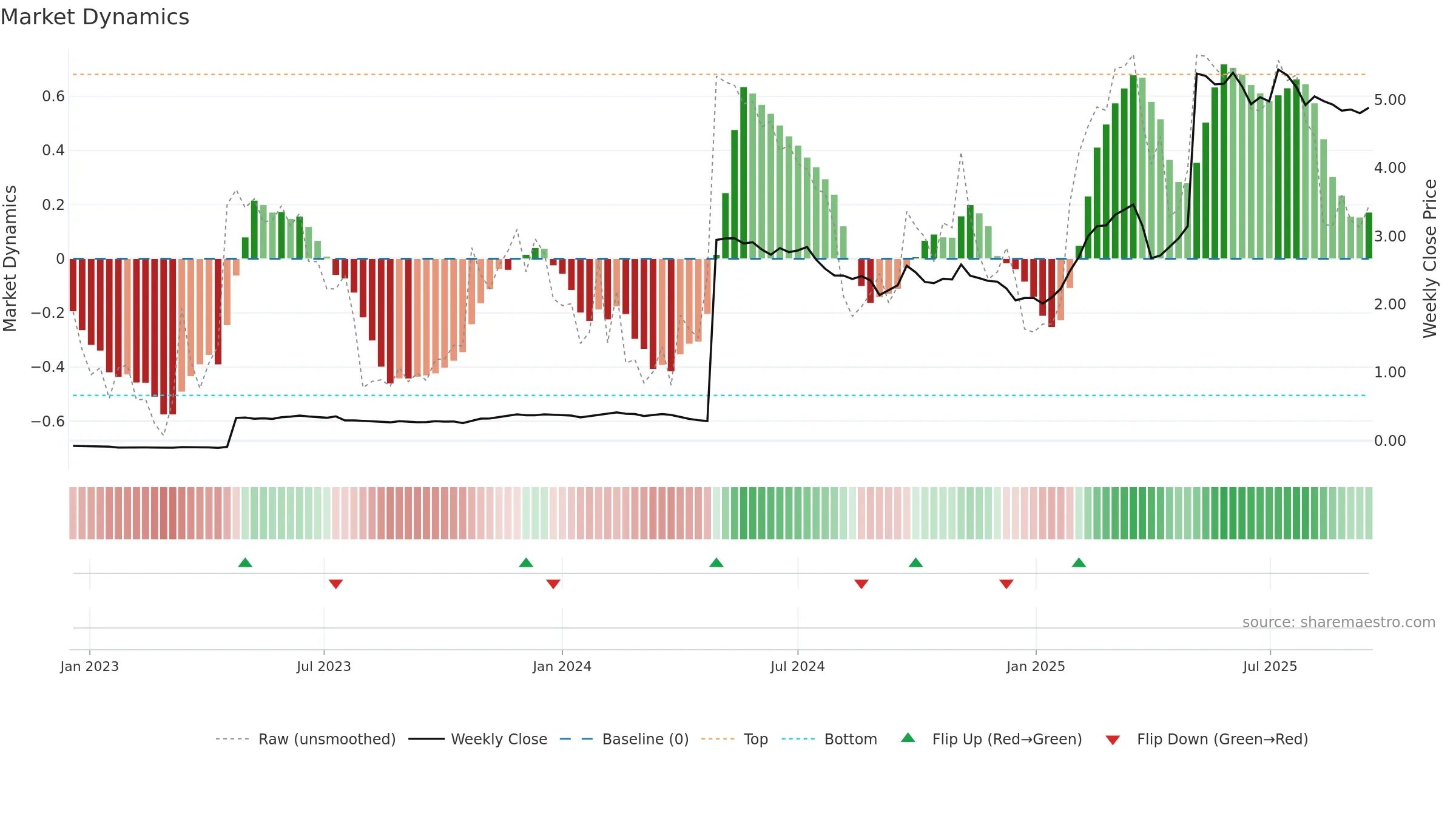

How to read this — Price slope is downward, indicating persistent supply pressure. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

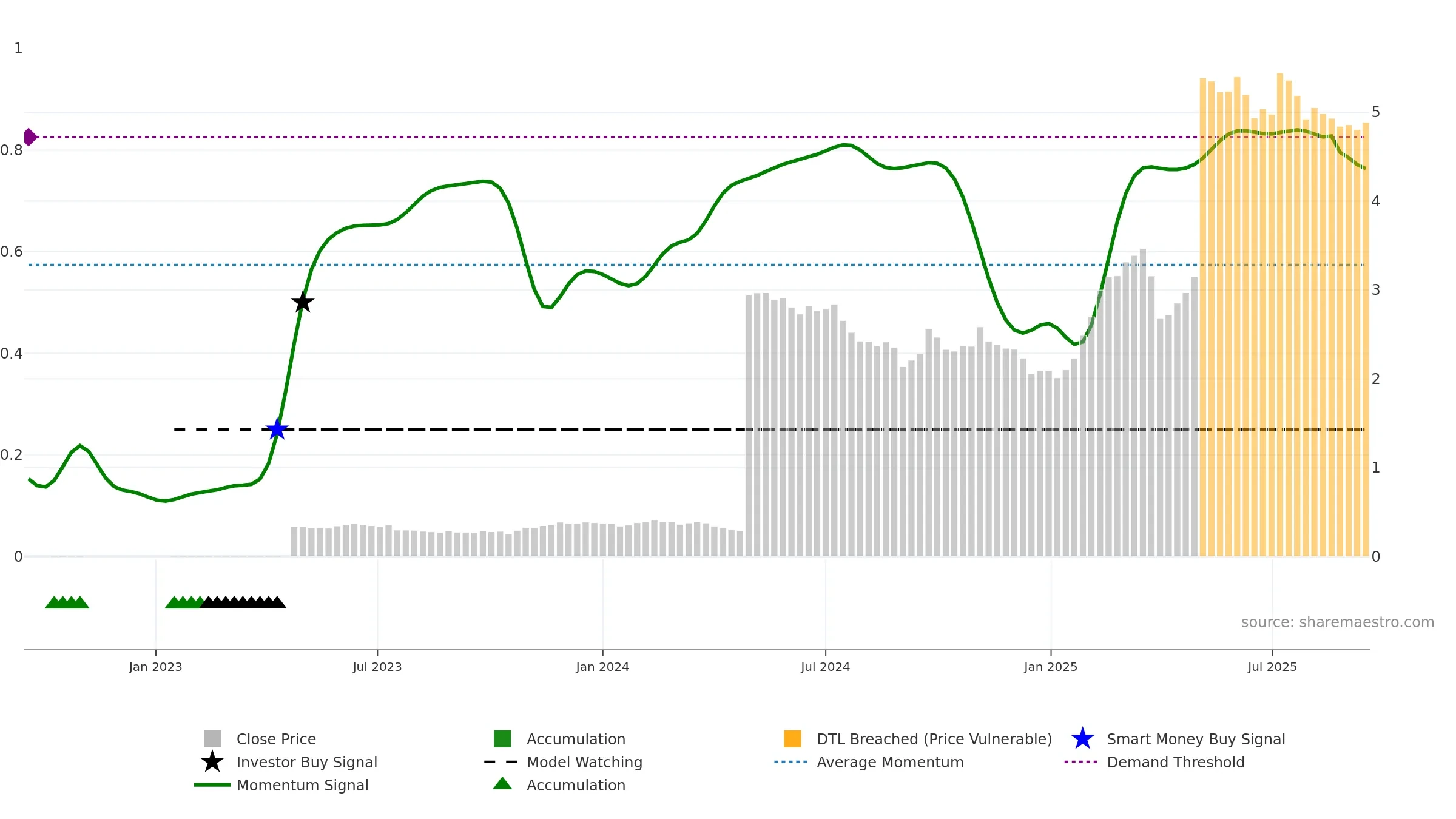

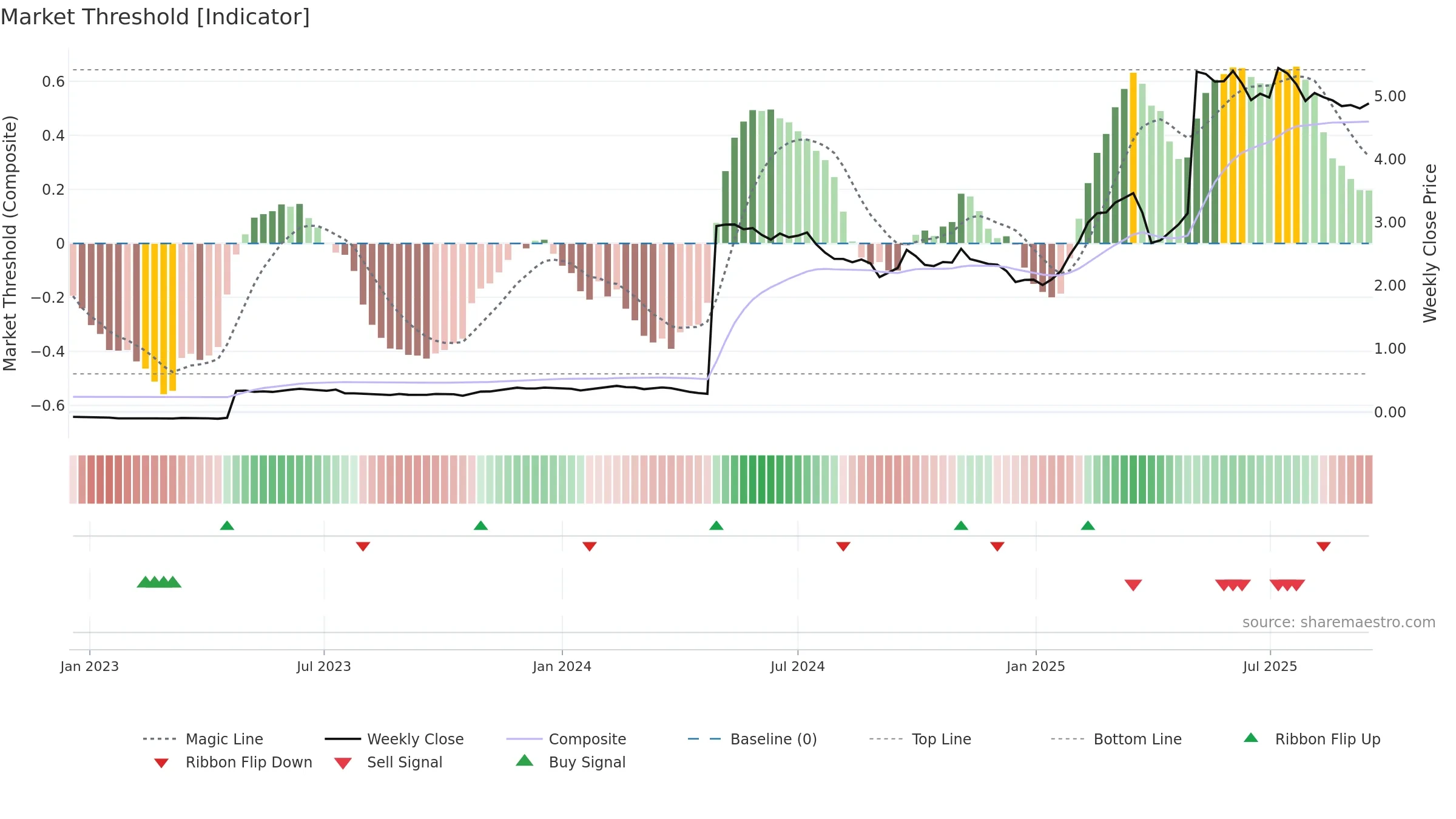

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

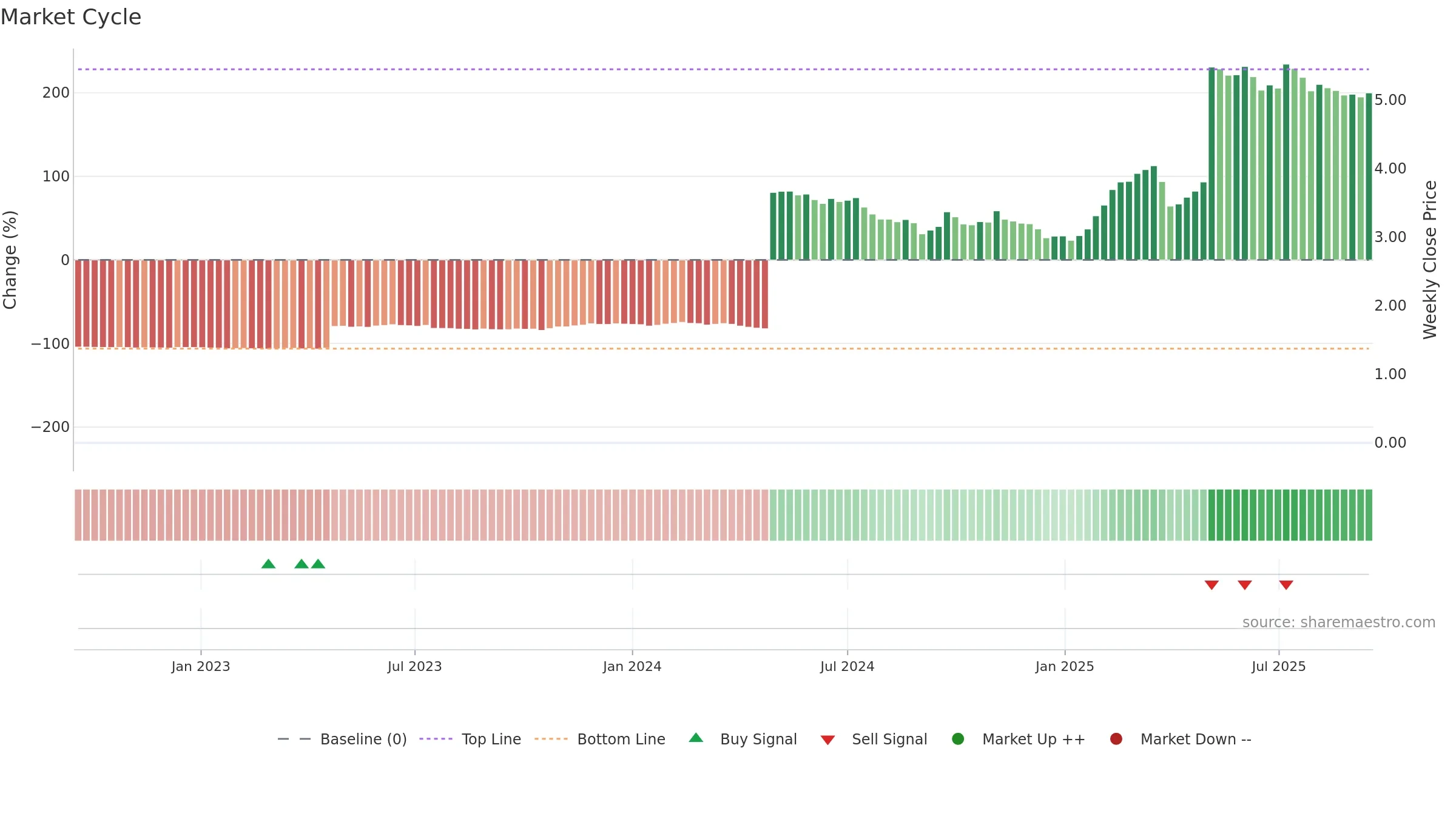

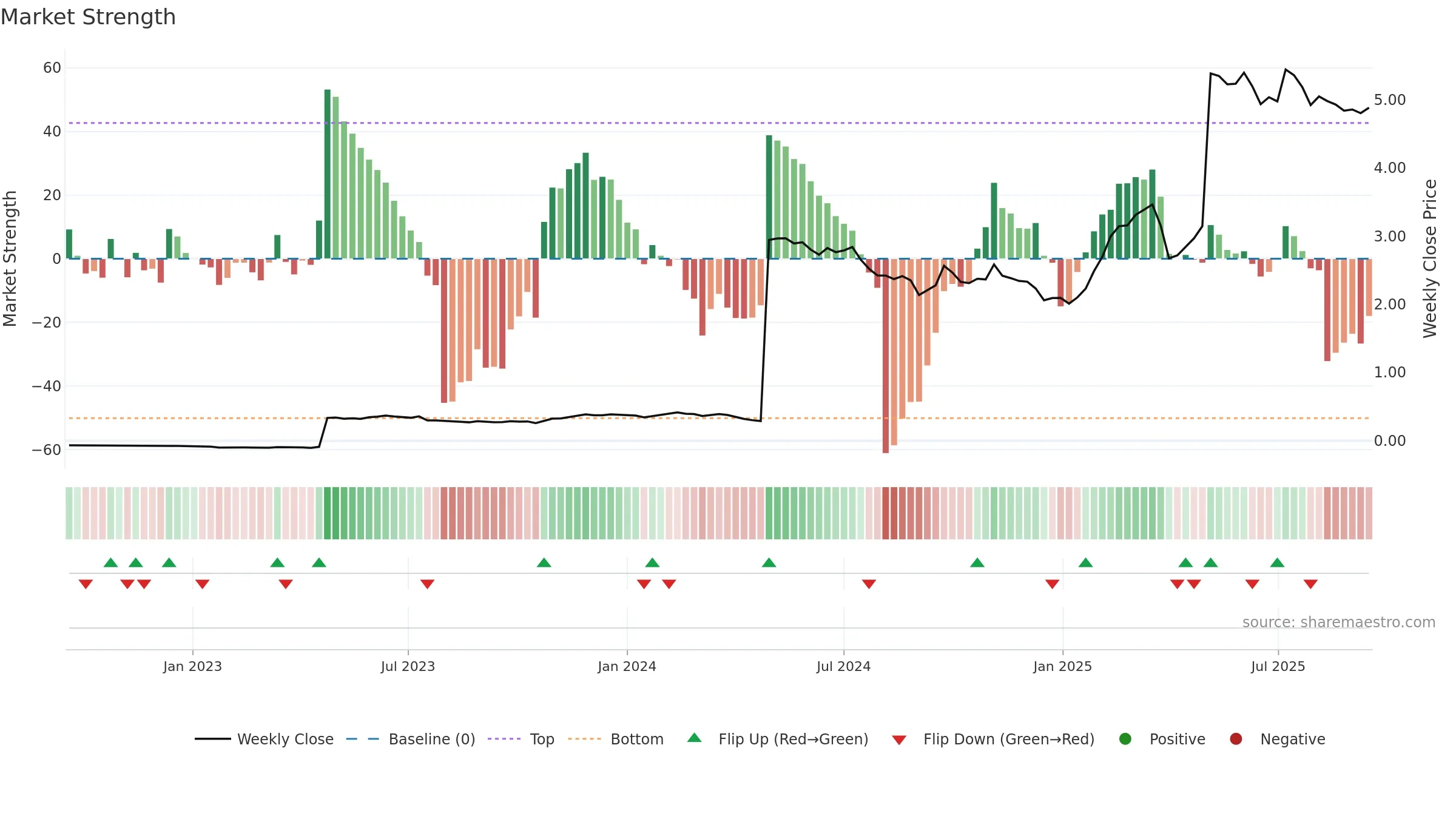

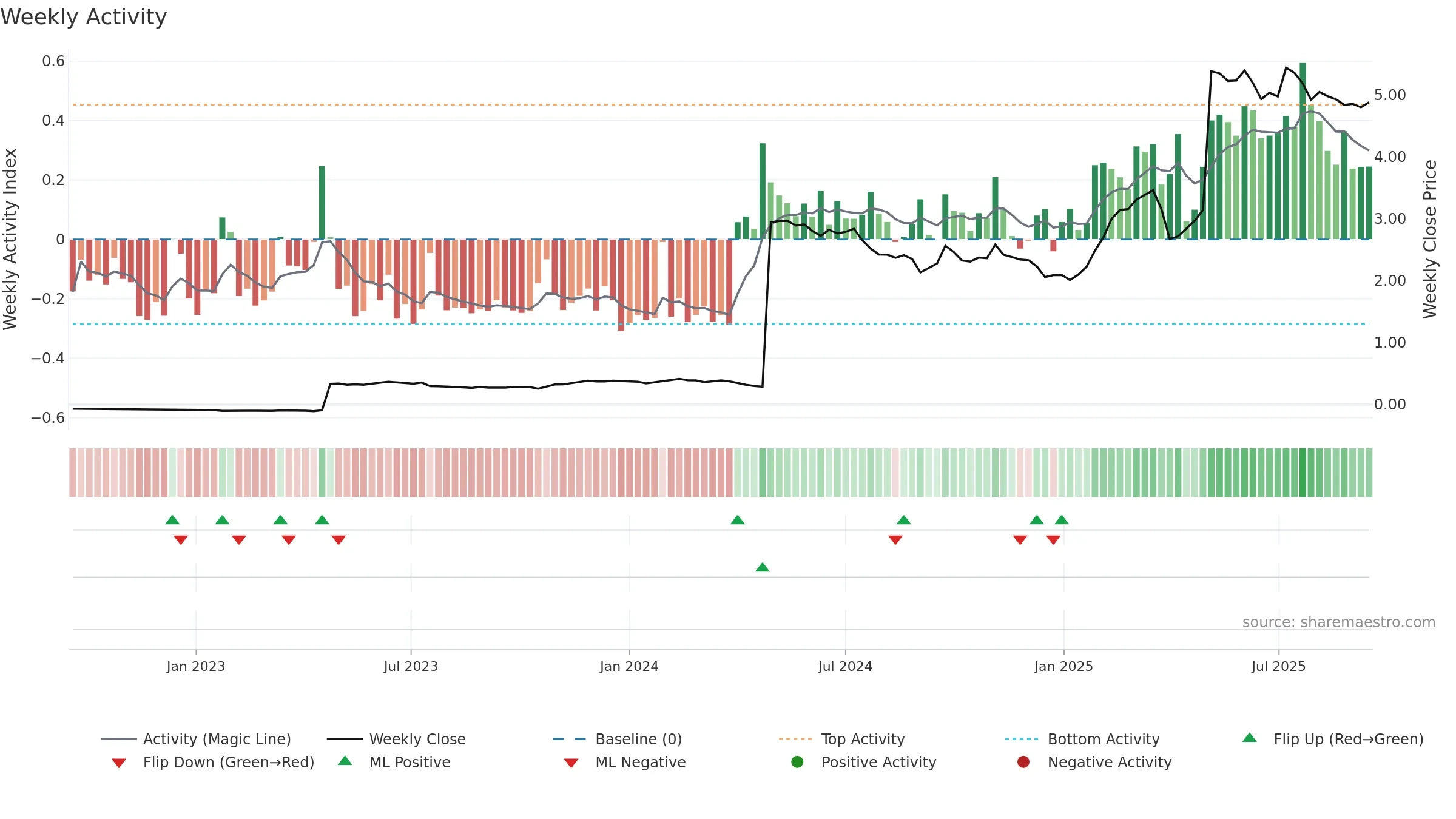

Negative setup. ★★☆☆☆ confidence. Price window: -0. Trend: Uptrend at Risk; gauge 76. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- High-level but rolling over (topping risk)

- Momentum is weak/falling

- Price is not above key averages

- Negative multi-week performance

Why: Price window -0.79% over 8w. Close is -3.29% below the prior-window high. Return volatility 2.44%. Volume trend falling. Liquidity convergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 3/4 (75.0%) • Distributing. Baseline deviation 1.96% (narrowing). Momentum neutral and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.